STATE GOVERNMENT

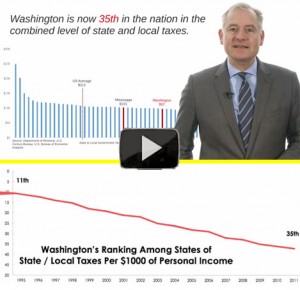

Washington state’s tax system: Unfair and outdated (video)

How did this happen?

In this must-see video, Rep. Reuven Carlyle (D-Seattle), Chairman of the House Finance Committee, outlines Washington’s broken and regressive tax structure; explains how the state’s high reliance on a sales tax has placed an unfair tax burden on its poorest residents, average earners and the state’s small businesses (while letting major industries and international corporations off the hook); and demonstrates how in the past 20 years Washington dropped from 11th to 35th in terms of the combined level of state and local taxes per $1,000 of earnings.

“Washington is on the march to becoming a low tax, low service, low quality-of-life state,” Carlyle says. “It’s time to acknowledge the profound implications of our revenue structure.”

Please watch it and share this with your friends, family and co-workers in Washington state.