NATIONAL

Desperate Republicans advancing Trump’s corporate tax cut bill

UPDATE (Nov. 13, 2017) — From The Hill — GOP tax bill clears hurdle, heads to House floor — The House Ways and Means Committee on Thursday approved House Republicans’ bill to rewrite the tax code. The measure — which reduces the number of individual tax rates, slashes the corporate tax rate and eliminates many deductions and credits — was approved on a party-line vote of 24-16.

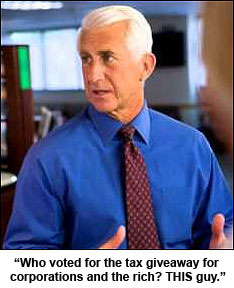

EDITOR’S NOTE — Lame duck Rep. Dave Reichert (R-8th) voted for this tax giveaway to corporations and the wealthy that will RAISE taxes for many of his middle-class constituents. Rep. Suzan DelBene (D-1st) voted “no.” The House Rules Committee is scheduled to meet Wednesday to set up floor debate, indicating an expected Thursday vote of the full House.

DelBene’s amendments to protect working families rejected by Reichert, Republicans

WASHINGTON, D.C. (Nov. 9, 2017) — House Republicans are poised today to advance from committee their controversial tax bill, which would raise taxes for millions of middle-class families to help pay for massive tax cuts for corporations and the wealthy. Rep. Suzan DelBene (D-1st) offered several amendments this week to protect working families, including one to repeal the so-called “Cadillac tax” on high-cost health plans, but those efforts were summarily rejected by Republicans desperate to ram the tax bill through Congress by Christmas-time.

“My amendment will, once and for all, repeal the tax that both Democrats and Republicans agree on, and give American families some certainty so they can plan,” DelBene said. “This tax on hardworking Americans’ healthcare plans disproportionately impacts people like the brave first responders who have been battling wildfires out west and delivering life-saving aid to people who have been impacted by recent hurricanes.”

Republicans also rejected a “Stop Outsourcing of American Jobs” amendment to require that multinational corporations looking to invest offshore pay the same tax rate as small businesses or domestic companies investing here in America. All these Democratic amendments were defeated on party-line votes, with 16 Democrats voting in favor and 23 Republicans voting against.

As a result, that committee is poised today to advance the measure on a straight partisan vote. Republicans and President Donald Trump are desperate to accomplish something demanded by their mega-donors after a string of failures and infighting on their agenda this year.

Reichert claims that the House tax plan “puts American workers and families first, supports our job-creators, and strengthens America’s competitiveness across the globe.”

A New York Times analysis of the House bill similarly found that “nearly half of all middle-class families would pay more in taxes in 2026 than they would under current rules if the proposed House tax bill became law, and about one-third would pay more in 2018, a striking finding for a bill promoted as a middle-class tax cut.”

That’s why a united Democratic caucus, including Rep. DelBene, intend to vote against the bill in committee today. She reminded her colleagues Wednesday that the purpose of the tax code is not to give special breaks to corporations and the wealthiest, but to fund a functioning government and support an environment where every middle-class families can succeed.

SCOTUS Justice Holmes once said, “Taxes are what we pay for civilized society.” The purpose of the tax code is not to give special breaks to corporations and the wealthiest, but to fund a functioning government & support an environment where every #middleclass family can succeed. pic.twitter.com/jldVuXSYbG

— Rep. Suzan DelBene (@RepDelBene) November 8, 2017

For more information, read the AFL-CIO’s “Top Reasons Why the Republican Tax Bill is Bad for Working People.”