LOCAL

Washington’s ‘business friendly’ tax climate

OLYMPIA (Jan. 29) — “We must no longer allow Washington to be one of the ten most expensive states in which to operate a business,” says Republican Attorney General Rob McKenna, as he makes his case for why he should be elected governor this fall.

This talking point is nothing new, borne long ago from the communion of the state’s corporate lobbying groups, its business-funded think tanks and its sympathetic media pundits. Like McKenna, GOP gubernatorial candidate Dino Rossi tried to convince voters that business taxes and costs are too high here — twice. But that didn’t work out for him.

Perhaps that is because it’s not true. And it’s getting less and less true every year.

Last week, Washington was again ranked as having one of the “most competitive” business tax systems in the nation by the conservative Washington, D.C.-based Tax Foundation. Its new 2012 state-by-state rankings list Washington as having the 7th best business tax climate, up from 8th last year, 11th two years ago, and 20th a decade ago.

Last week, Washington was again ranked as having one of the “most competitive” business tax systems in the nation by the conservative Washington, D.C.-based Tax Foundation. Its new 2012 state-by-state rankings list Washington as having the 7th best business tax climate, up from 8th last year, 11th two years ago, and 20th a decade ago.

The Tax Foundation is a think tank funded by U.S. corporate interests, with ties to the notorious right-wing Koch brothers and the American Legislative Exchange Council. Its plain-and-simple agenda is to lower business taxes. So when these folks say your state is among the best at keeping business taxes low — and one of only two states in the top 10 with a legislature controlled by Democrats — that’s about as high praise as you can expect from them. (All five of the “worst” states have Democratic-controlled legislatures.)

The (Vancouver) Columbian reported last week that Ken Fisher, CEO of the California-based Fisher Investments, decided to expand their business in Camas largely because of Washington’s advantageous tax climate. He expects to eventually employ 450 people — making between $75,000 and $200,000 a year — in the new building the company just built there.

In recent years, the Washington State Labor Council has published a report, “Outside the Echo Chamber,” that refutes the continuing myth that our state has a poor business climate. The Tax Foundation report is one of many that measure corporate taxes, regulation and other factors in determining which states are the “best for business,” and Washington consistently ranks among the best.

But, but, but…

Corporate lobbying groups in Washington insist that any such positive rankings give too much weight to Washington’s lack of a personal income tax. They complain that the state’s Business & Occupation Tax on gross receipts is particularly onerous because businesses must pay it even if they are not yet profitable, and studies like this don’t take that into account.

But they do. The Tax Foundation notes (Page 11) that “a growing number” of states, including Washington, have gross receipts taxes so the study includes a formula for comparing such states with those that tax only net income. In that particular category, Washington places 30th. But because of its comparatively low taxes and employer costs in other areas of business, our state still ranks among the best — and continues to climb the rankings.

Washington’s continued ascension may be attributable to the significant business tax breaks passed in recent years. For example, as our state climbed from 20th to 7th in the overall rankings in the past 10 years, Washington has significantly cut its B&O taxes for aerospace companies and approved multiple tax breaks for industries ranging from grain exporters to newspapers.

Amid the Great Recession, as some states have raised corporate tax rates or ended these tax breaks to help address major revenue shortfalls, no significant business tax breaks have been eliminated in Washington.

McKenna & Co.: But ‘we suck’ at other things

Washington’s internal corporate echo chamber also claims that positive rankings like those from the Tax Foundation don’t account for our state having among the highest unemployment insurance and workers’ compensation costs in the nation. These costs have been among the grievances cited in the past by The Boeing Co., whose former CEO memorably assessed our business climate by saying, “We suck.”

It’s a meme that continues today as gubernatorial candidate McKenna says our state’s high costs for workers’ compensation are why he supports allowing private insurance companies to sell workers’ comp coverage in Washington. (That idea was soundly rejected by the state’s voters, 59-41, in 2010.)

It’s a meme that continues today as gubernatorial candidate McKenna says our state’s high costs for workers’ compensation are why he supports allowing private insurance companies to sell workers’ comp coverage in Washington. (That idea was soundly rejected by the state’s voters, 59-41, in 2010.)

But again, the anti-tax think-tankers outside our state disagree.

In the 2012 Tax Foundation rankings, Washington has jumped from 24th to 18th best in terms of the “competitiveness of its unemployment insurance costs for employers.” (See Page 29.) That is the biggest jump in the rankings of any state over the past year. It is likely attributable to the fact that our healthy system has succeeded in lowering employers’ rates at a time when high unemployment has bankrupted other states’ systems and forced them to raise rates and borrow from the federal government to pay jobless benefits.

The cost of workers’ compensation is not factored into the Tax Foundation’s rankings. (Maybe that’s because it isn’t really a “tax,” it is an insurance premium to cover workplace injuries.) However, the Oregon Department of Consumer and Business Services conducts a biannual state-by-state study of workers’ compensation premiums that is widely cited not only among public policy experts and state labor agencies across the nation, but also by private insurance professionals.

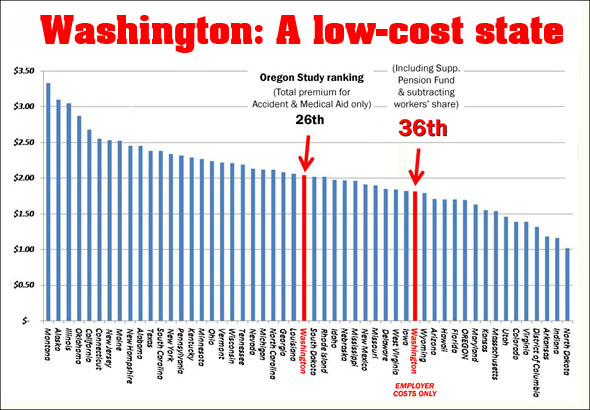

The latest edition, published in October 2010, found that Washington state had the 26th highest overall premiums in the nation. So, right smack dab in the middle. But the news is even better for employers here. Washington is the ONLY state in the nation where workers pay a portion of the workers’ compensation premiums, currently estimated to be about one-quarter of total premiums. When that and the cost of supplemental pensions are factored in — which the Oregon study does not — Washington ranks 36th. (Click to enlarge the chart.) That means the costs for employers here are the 16th lowest of all states, including D.C.

The latest edition, published in October 2010, found that Washington state had the 26th highest overall premiums in the nation. So, right smack dab in the middle. But the news is even better for employers here. Washington is the ONLY state in the nation where workers pay a portion of the workers’ compensation premiums, currently estimated to be about one-quarter of total premiums. When that and the cost of supplemental pensions are factored in — which the Oregon study does not — Washington ranks 36th. (Click to enlarge the chart.) That means the costs for employers here are the 16th lowest of all states, including D.C.

‘No comment,’ unless it’s bad news

The Stand contacted Rob McKenna’s campaign about his assertions that Washington has a negative business climate in the context of the Tax Foundation’s new report. His campaign declined to respond.

Likewise, the Association of Washington Business had nothing to say about the good news in last week’s Tax Foundation report.

But this week, the AWB is touting a new study from its parent organization, the U.S. Chamber of Commerce, that (naturally) ranks Washington as a “poor” place to do business. That study says our state scores poorly because of our labor standards that exceed the federal minimums (such as our voter-approved state minimum wage), our high workers’ comp benefits (not employer costs, which are comparatively low), and the fact that Washington is not a so-called “right to work” state that discourages unionization.

“Washington… has one of the highest rates of unionization in the private sector, ” the Chamber complains. “Only Hawaii, New York and Nevada have a higher percentage of private-sector union members.”

Apparently, in the current political climate, the AWB and the U.S. Chamber have decided that discouraging workers from forming unions and bargaining collectively is even more important than what businesses pay in taxes. That may tell you all you need to know about how much lower they think their taxes can go.