NEWS ROUNDUP

Big MAX order, Obama tax cut, hidden corporate cash…

Monday, July 9, 2012

BOEING

► From Bloomberg — Boeing lands $7.2 billion order from Air Lease Corp. — The Boeing Co. kicked off this year’s Farnborough air show with a $7.2 billion order from Steven Udvar-Hazy’s Air Lease Corp. for single-aisle aircraft, as the manufacturer promotes its new, fuel-efficient 737 MAX. The firm order is for 60 737 MAX 8 and 15 737 MAX 9 airplanes and is the first for that type of aircraft from a leasing company.

► At The Street — Machinists will seeks to organize Airbus plant in Alabama — “We have every intention to try to organize the facility,” said IAM President Tom Buffenbarger, in an interview as he prepared to attend the Farnborough Air Show in England, where he will meet with Airbus officials on Wednesday. “This union has a good relationship with Airbus and I look forward to engaging with them,” he said.

► At The Street — Machinists will seeks to organize Airbus plant in Alabama — “We have every intention to try to organize the facility,” said IAM President Tom Buffenbarger, in an interview as he prepared to attend the Farnborough Air Show in England, where he will meet with Airbus officials on Wednesday. “This union has a good relationship with Airbus and I look forward to engaging with them,” he said.

► In today’s NY Times — Boeing says Airbus move no cause for concern — “At the end of the day, you compete with the best products, with the best value, the best performance and the best relationships,” said Raymond L. Conner, the new head of Boeing Commercial Airplanes. “If Airbus can bring a better value proposition to the game, then the U.S. airlines will take that into account.”

► In the Seattle Times — Boeing’s new jet boss Ray Conner a born salesman — On the eve of the Farnborough Air Show, Ray Conner — the new chief executive at Boeing Commercial Airplanes — showed some of the swagger of a top salesman Sunday.

► In the PS Business Journal — Boeing revamps 737 wing plant to speed up work, take on Airbus — Boeing is converting its 737 wing factory in Renton from fixed assembly tooling into two high-efficiency “moving lines,” a key tactic in the plane maker’s fight to compete against rival Airbus in the popular single-aisle jet category.

► In the PS Business Journal — Boeing revamps 737 wing plant to speed up work, take on Airbus — Boeing is converting its 737 wing factory in Renton from fixed assembly tooling into two high-efficiency “moving lines,” a key tactic in the plane maker’s fight to compete against rival Airbus in the popular single-aisle jet category.

HEALTH CARE

► In the NY Times — Brawling over health care moves to rules on exchanges — At issue is whether the subsidies for lower-income people will be available in exchanges set up and run by the federal government in states that fail or refuse to establish their own exchanges. Critics say the law allows subsidies only for people who obtain coverage through state-run exchanges. The White House says the law can be read to allow subsidies for people who get coverage in federal exchanges as well.

PREVIOUSLY in The Stand — A significant, historic victory on health plan standards (March 7 – RE: Washington’s Health Exchange)

► In the (Everett) Herald — We can’t afford not to insure all (by Larry Donohue, M.D.) — The Preamble to our Constitution states “… promote the general welfare …” At least 21 religions have an ethic of reciprocity, or Golden Rule. “Do unto others as you would have others do unto you.” But, if that doesn’t convince you, know that our society and our economy are damaged by poor health and diminished life spans of the uninsureds.

NATIONAL

► In today’s Washington Post — Obama to propose tax-cut extension for middle-class households — President Obama on Monday will propose a one-year extension of the George W. Bush-era tax cuts for people earning less than $250,000. The move is likely to set up another standoff with Republicans in Congress, who support extending the tax cuts permanently for all income levels, not just for those earning less than $250,000 per year.

► In today’s Washington Post — Obama to propose tax-cut extension for middle-class households — President Obama on Monday will propose a one-year extension of the George W. Bush-era tax cuts for people earning less than $250,000. The move is likely to set up another standoff with Republicans in Congress, who support extending the tax cuts permanently for all income levels, not just for those earning less than $250,000 per year.

► In today’s NY Times — Forced labor on American shores (editorial) — A Louisiana scandal points to pervasive exploitation of legal guest workers. Congress needs to make sure that profits are not built upon the erosion of workplace conditions and laborers’ rights.

► In today’s NY Times — Mitt’s gray areas (by Paul Krugman) — Mitt Romney’s refusal to come clean about his personal finances suggests that he and his advisers believe that voters would be less likely to support him if they knew the truth about his investments. Unless he does reveal the truth, we can only assume that he’s hiding something seriously damaging.

TODAY’S MUST-READ

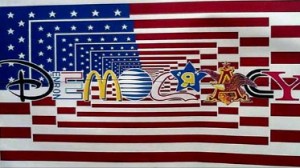

► In the NY Times — Tax-exempt groups shield political gifts of businesses — Two years after the Supreme Court’s Citizens United decision opened the door for corporate spending on elections, relatively little money has flowed from company treasuries into “super PACs,” which can accept unlimited contributions but must also disclose donors. Instead, there is growing evidence that large corporations are trying to influence campaigns by donating money to tax-exempt organizations that can spend millions of dollars without being subject to the disclosure requirements that apply to candidates, parties and PACs.

► In the NY Times — Tax-exempt groups shield political gifts of businesses — Two years after the Supreme Court’s Citizens United decision opened the door for corporate spending on elections, relatively little money has flowed from company treasuries into “super PACs,” which can accept unlimited contributions but must also disclose donors. Instead, there is growing evidence that large corporations are trying to influence campaigns by donating money to tax-exempt organizations that can spend millions of dollars without being subject to the disclosure requirements that apply to candidates, parties and PACs.

The secrecy shrouding these groups makes a full accounting of corporate influence on the electoral process impossible. But glimpses of their donors emerged in a New York Times review of corporate governance reports, tax returns of nonprofit organizations and regulatory filings by insurers and labor unions.

The Stand posts links to Washington state and national news of interest every weekday morning by 9 a.m.