STATE GOVERNMENT

Workers’ comp rates steady again in 2013

By DAVID GROVES

The Stand

OLYMPIA (Sept. 18) — The Washington State Department of Labor and Industries announced Monday that it is proposing no increase in the average rate for workers’ compensation insurance for 2012. If adopted, this would be the second straight year with no increase in workers’ comp rates.

L&I said that savings due to the 2011 legislative changes in workers’ compensation law are beating expectations, with the state now projecting to save $1.5 billion over four years, $300 million higher than originally estimated. In the wake of this announcement, business lobbying groups that supported those “reforms” are touting their success at reining in costs and demonstrating that such “reform… is not only possible, but it pays dividends.”

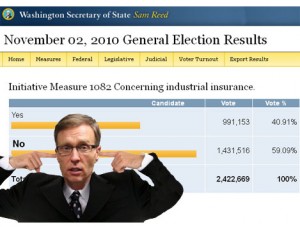

One of the new “reforms” that Republican gubernatorial candidate Rob McKenna is advocating is to privatize the workers’ compensation system — a business-backed proposal that Washington voters soundly rejected just two years ago by more than an 18-point margin.

One of the new “reforms” that Republican gubernatorial candidate Rob McKenna is advocating is to privatize the workers’ compensation system — a business-backed proposal that Washington voters soundly rejected just two years ago by more than an 18-point margin.

But what most legislative insiders expect business lobbying groups to seek in 2013 is to expand the most controversial aspect of the 2011 legislative changes, adamantly opposed by organized labor and advocates for injured workers: the legalization of lump-sum buyouts of certain injured workers — also known as “structured settlements.”

Where the savings really come from

As it turns out, these lump-sum buyouts appear to have had little or nothing to do with the short-term system savings L&I is now anticipating. Instead, the 2011 changes that were agreed to by both labor and business interests, coupled with a weak economy and reduced work hours, are responsible for the savings that are enabling the rate freeze.

“Savings that can be attributed to the 2011 legislation are coming from the elements that labor agreed to, including more efficient claims management, subsidies for return-to-work efforts, and freezing the COLA on benefits,” said Jeff Johnson, President of the Washington State Labor Council, AFL-CIO. “Although ‘structured settlements’ may create savings down the road, they will do so at the expense of injured workers and their families buy lowering their benefits and their standard of living.”

“Savings that can be attributed to the 2011 legislation are coming from the elements that labor agreed to, including more efficient claims management, subsidies for return-to-work efforts, and freezing the COLA on benefits,” said Jeff Johnson, President of the Washington State Labor Council, AFL-CIO. “Although ‘structured settlements’ may create savings down the road, they will do so at the expense of injured workers and their families buy lowering their benefits and their standard of living.”

Beginning Jan. 1, 2012, Washington businesses could negotiate with injured workers over age 55 (age 50 starting in 2016) to settle for less via structured lump-sum payments than they would otherwise receive. Business lobbying groups strongly supported this change, and would like to expand these settlements to injured workers of all ages, because it partially accomplishes what their unsuccessful 2010 ballot initiative aimed to do. These settlements open the door to private claims-adjusting insurers looking to profit through buyouts.

Labor has argued that families that lose their income due to work injury are subject to extraordinary short-term financial pressures and could agree to buyouts that are against their best interests in the long term. In fact, any projected savings to the workers’ comp system are predicated on exactly that — workers agreeing to accept less than their guaranteed benefit.

But as it turns out, far fewer injured workers are seeking the settlements than the state originally anticipated. The Seattle Times reported in July, that L&I had geared up to handle as many as 3,000 requests for lump-sum buyouts this year and the state board that gives final approval for the settlements was expected to receive about 1,350. But halfway through the year, L&I had received just 300 settlement applications and the board had received fewer than 30 proposed deals.

“What we’re learning from the good news about holding rates steady for another year is that similar savings could have been achieved by just passing the changes labor and business negotiated,” Johnson said. “Changing the system into a roll of the dice where certain families gamble on their long-term needs was unnecessary and should be reconsidered by lawmakers.”

Other factors that are saving the system money

The still-struggling national economy and persistent unemployment is also a significant factor in the state’s projected workers’ compensation savings.

“One of the biggest reasons rates are holding steady for another year is simply reduced claim frequency related to high unemployment,” Johnson said. “When workers don’t feel secure in their jobs, they are even less likely to report accidents over fear of losing both income and their jobs.”

L&I acknowledged this in its list of other factors responsible for lower projected costs in 2013:

- Fewer claims in high hazard industries like construction are resulting in fewer long-term disabilities;

- Overall claim frequency, or the number of claims per 100 workers, has gone down by 6.2%;

- L&I has held medical cost growth below 4% over the past five quarters and expects continuing to do so in 2013 with the new provider network and health technology assessments;

- L&I is resolving claims more quickly as a result of Lean and other improvements.

What happened to the ‘Mother of All Rate Increases”?

At its June meeting, business and labor interests on the Workers’ Compensation Advisory Committee decided to explore possible scenarios for rebuilding the workers’ compensation State Fund’s reserves, which the State Auditor has said are too low. The worst-case of those scenarios — one that envisioned 19% rate increases for 10 consecutive years — sent business lobbyists into a tizzy, predicting the “mother of all rate increases” in 2013 and that the issue would be a major one in this fall’s gubernatorial race between McKenna and Democratic candidate Jay Inslee.

As L&I’s 2013 rate proposal demonstrates, that manufactured panic was overblown.

L&I says reserves remain low by industry standards due to increased liabilities, investment losses and drawing down the reserves to hold down rates during the recession. But its proposal to freeze 2013 rates includes putting an additional $82 million into the State Fund reserves by the end of 2013.

“This proposal is a good step forward in rebuilding our reserves to safe policy levels to ensure a stable system for workers and businesses in the future,” Johnson said. Washington is the only state where workers pay a substantial portion — about 24% — of workers’ compensation premiums.

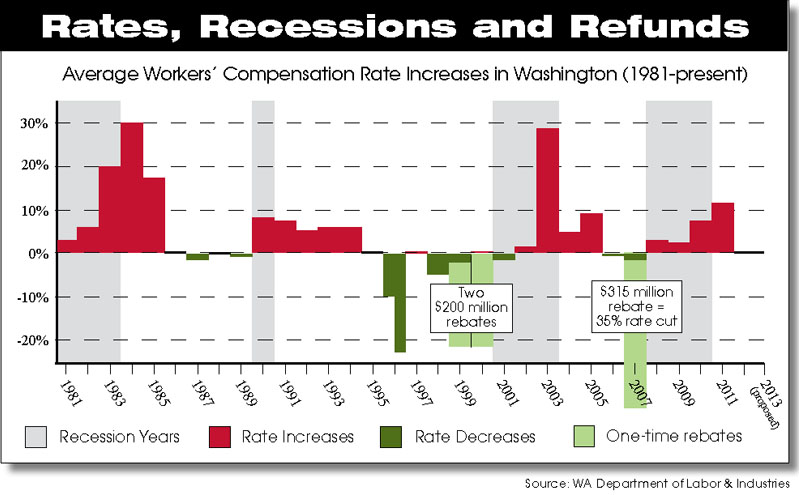

Organized labor has argued that inadequate reserves and recession-related rate increases have been exacerbated by rate cuts, rebates and refunds offered to employers in “good years” past. For example, in 2007, right before the recession hit, workers’ comp rates were lowered 2% and a 6-month “rate holiday” was granted — where employers and workers paid nothing for the medical portion of their insurance. That cost the system $315 million, or the 2007 equivalent of a 35% rate decrease. By comparison, the most recent 12% rate increase in 2011 brought in about $196 million.

Johnson added: “It’s important to remember that no good news is good enough for certain employers and business lobbying groups. By January’s legislative session, they will be saying that rate freeze was nice but a rate cut would be even better. And as always, they will have some ideas about how to cut injured workers’ benefits to pay for those lower rates. We just have to remain vigilant and remind all that the system is there to provide ‘sure and certain relief’ for injured workers and their families.”

Public hearings on the proposed 2012 rates will be held in:

- Tukwila, Oct. 23, 10 a.m., L&I office.

- Bellingham, Oct. 23, 1 p.m., Public Library Lecture Room.

- Spokane, Oct. 24, 10 a.m., CenterPlace Event Center.

- Richland, Oct. 25, 10 a.m., Community Center Activity Room.

- Tumwater, Oct. 26, 10 a.m., L&I Auditorium.

- Vancouver, Oct. 29, 10 a.m., Red Lion at the Quay, Quayside Portside Room.

More information regarding the rate proposal is available at www.Rates.Lni.wa.gov. The final rates will be adopted in early December and go into effect Jan. 1, 2013.