ELECTION

How Washington ballot measures affect state budget

The Washington State Budget and Policy Center has posted the following summary of ballot measures with a fiscal impact on the state. It is crossposted here with the authors’ permission.

By ANDY NICHOLAS and MICHAEL MITCHELL

Voters will make some important choices about Washington state’s economic future in the coming weeks as they consider a range of initiative and referendum measures appearing on the November 6th ballot.

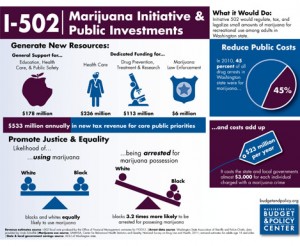

Initiative 502: Regulating marijuana will boost key state investments

Initiative 502 regulates, taxes, and legalizes small amounts of marijuana for adult recreational use in Washington state. This measure would also have a positive impact on such important state investments as education, health care, and public safety, while enhancing justice and equality.

Initiative 502 regulates, taxes, and legalizes small amounts of marijuana for adult recreational use in Washington state. This measure would also have a positive impact on such important state investments as education, health care, and public safety, while enhancing justice and equality.

Check out a recent schmudget post on I-502 for more information. (Click the chart to enlarge.)

Initiative 1185: Supermajority law will cause more pain for Washington state’s economy

Initiative 1185 would bar policymakers from raising much-needed public resources without a two-thirds “supermajority” vote of the legislature or a vote of the people. This initiative extends the supermajority requirement for two more years, allowing it to continue to do damage to Washington’s economy.

The supermajority law has given a small band of ideologically-driven lawmakers veto power over the entire state budget. With the disproportionate power this law gives them, the minority has been able to overrule the majority to protect wasteful tax breaks and make deep and painful cuts to health care, child care, senior services, and other vital investments. These cuts have cost thousands of jobs and have deepened and prolonged Washington’s economic recovery.

For more information on how I-1185’s supermajority law has harmed Washington’s economic recovery, read our policy brief “Supermajority Law’s Damaging Legacy.”

Also, check out this schmudget post, which explains that policymakers responded to recessions much more responsibly prior to supermajority law’s enactment.

Advisory vote on narrowing a wasteful tax break

In early 2012, the legislature voted to narrow a tax break claimed mostly by large out-of-state banks (known as Engrossed Senate Bill 6635). In exchange for agreeing to limit that tax break, a small group of legislators demanded the expansion and extension of other tax breaks. This means the state will actually lose more revenue in the next budget cycle than it will recoup from narrowing the tax break for banks.

Because state law requires a nonbinding “public advisory vote” when policymakers raise taxes or curtail tax breaks, Washingtonians will have an opportunity to weigh in. However, because the vote is merely advisory, the results will not alter the law. In other words, voting “no” would not restore the bank tax break.

Senate Joint Resolution 8223: Won’t solve state universities’ funding problems

This resolution would give the University of Washington (UW) and Washington State University (WSU) more flexibility in their investments with the hope of bringing in more funding. Importantly it doesn’t address the real problem facing public universities: the massive cuts policymakers have made in support to higher education since 2009.

The resolution would change the state constitution to give UW and WSU the option of investing operating funds in stocks and bonds. These state universities now are allowed to invest only in government bonds and other U.S. government-back securities.

By broadening the range of assets, UW hopes to increase its operating funds by $10 million to $20 million over the next 20 years. WSU estimates additional funds from this change would amount to $3 million to $10 million over the same period.

But new resources generated by this resolution would be a drop in the bucket compared to the $1.4 billion in cuts experienced in our higher education system over the past few years. As a direct result of cuts, tuition has skyrocketed and universities cannot meet the financial aid needs of the state’s lower- and moderate income students. No investment strategy could remedy cuts of this magnitude.

Engrossed Senate Joint Resolution 8221: Altering the “debt limit”

Washington, like other states, routinely borrows money, by selling bonds, for example, to finance large building projects like new schools, prisons, roads and bridges. This resolution makes three critical changes to how much debt the state can issue, but it is largely a solution in search of a problem. That’s because for more than a decade, interest payments on Washington’s state debt have remained relatively stable as a share of state spending. And, this borrowing makes sure that resources are available to make critical investments in infrastructure that are essential to supporting a strong economy in Washington state.

Specifically, the resolution:

- Lowers the constitutional debt limit: The resolution would gradually lower the amount of debt the state can issue as a share of general revenues, restricting the state’s ability to issue debt for important infrastructure investments, even when interest rates are low and borrowing can be cheap.

- Broadens the definition of general revenue: This resolution amends the state constitution to classify property tax revenue as general revenue, which allows the state greater ability to issue debt. Broadening the definition of general revenue partially offsets the impacts of lowering the constitutional debt limit.

- Lengthens the measurement period for debt capacity: Currently, when calculating the debt limit, lawmakers take the amount owed for the current year and divide it by the average general revenues of the three prior fiscal years. This resolution increases the number of years used in calculating the average of general revenue from the three previous years to six. This change will reduce dramatic fluctuations in the debt limit, particularly at the onset of a recession.

Overall, ESJR 8221 would not dramatically alter Washington’s current practices for issuing debt. It is important to note, however, that Washington does not have excessive levels of debt and the state’s credit rating remains one of the highest in the nation.

For more information about these and other budget-related issues facing the state, visit the Washington State Budget and Policy Center website.