STATE GOVERNMENT

Your shrinking state, federal governments

Following is today’s edition of the Washington State Labor Council’s Legislative Update newsletter (PDF version).

OLYMPIA (April 24, 2013) — Amid the debate over economy-stifling job-killing government austerity, one myth continues to ring loudly among the American public: that despite all the budget cuts, government is still growing. It’s not just right-wing politicians and think tanks that are perpetuating this myth, it’s also the business lobbying groups. Yes, the same folks who bemoan the state’s freight mobility problems and its lack of skilled and educated workers, among other things, also regularly deliver the conservative clarion call against “big government.”

OLYMPIA (April 24, 2013) — Amid the debate over economy-stifling job-killing government austerity, one myth continues to ring loudly among the American public: that despite all the budget cuts, government is still growing. It’s not just right-wing politicians and think tanks that are perpetuating this myth, it’s also the business lobbying groups. Yes, the same folks who bemoan the state’s freight mobility problems and its lack of skilled and educated workers, among other things, also regularly deliver the conservative clarion call against “big government.”

“As government grows ever larger in an attempt to provide more benefits to more people, it saps trillions of dollars from the private economy and ultimately deters job creation,” writes Association of Washington Business President Don Brunell in his latest newspaper column.

It is exactly this type of rhetoric — sustained for nearly a generation now — that fuels anti-government public sentiment. It elevates the likes of Tim Eyman, a comical tax crank who once would have been marginalized as a clearly self-interested flimflam man, into a voice of the oppressed taxpayer. It turns some Democrats into fiscal neoconservatives who congratulate themselves on all-cuts budgets that starve public services at a pace just gradual enough not to be detected in the short term. And it makes it very hard — near impossible, in fact — to have a reasonable debate about the need for more revenue for roads and bridges, essential public services, and public schools so underfunded that the state faces a court order to do better.

And, oh yeah, it’s not true.

Your government, at both the state and federal levels, is shrinking at an unprecedented rate. More and more economists now agree that government cuts are doing the exact opposite of what Mr. Brunell contends; all-cuts austerity budgets are slowing economic growth and harming the private sector.

Your government, at both the state and federal levels, is shrinking at an unprecedented rate. More and more economists now agree that government cuts are doing the exact opposite of what Mr. Brunell contends; all-cuts austerity budgets are slowing economic growth and harming the private sector.

In February, for the 31st consecutive month, the number of federal government jobs was less than it had been a year earlier. That surpasses the previous record of 30 straight months that occurred following World War II. This week, thanks to Congressional sequester cuts, tens of thousands of federal employees across the nation will start experiencing what Washington’s state employees have experienced, unpaid furloughs that cut their wages and hamper public services.

Set aside that image of paper-pushing bureaucrats in the other Washington. Instead, picture the tens of thousands of civilian defense workers right here at Joint Base Lewis-McChord and the Puget Sound Naval Shipyard, thousands of workers at Hanford nuclear reservation and many, many more who provide critical services like directing air traffic, safeguarding our environment and providing homeland security. These are middle-class working families in Washington state who will suffer as a result, as will the businesses in their communities.

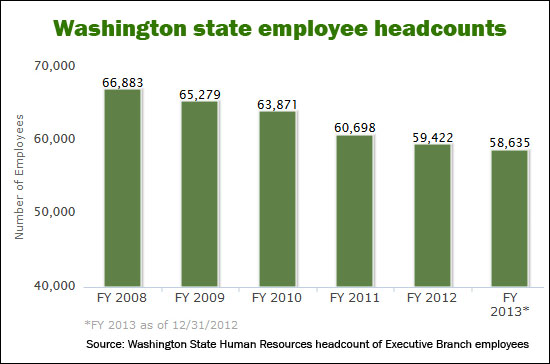

Meanwhile, the headcount of Washington state employees has dropped for five consecutive years from 66,883 to 58,635, according to state workforce data (see chart above), even as the state population they service has grown by another 1 million people.

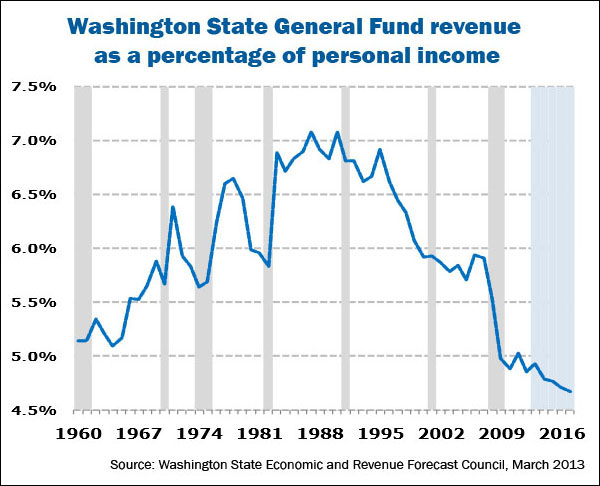

It is that growing population that creates the illusion of government growth. Even without additional revenue, our biennial budget will grow by more than $1 billion because there are more taxpayers paying for more students, more prisoners, more sick and disabled people, etc. But not higher taxes, mind you. In fact, you are paying less money to the state government as a percentage of your personal income than at any other time since the Washington State Economic and Revenue Forecast Council started recording it (see chart).

It is that growing population that creates the illusion of government growth. Even without additional revenue, our biennial budget will grow by more than $1 billion because there are more taxpayers paying for more students, more prisoners, more sick and disabled people, etc. But not higher taxes, mind you. In fact, you are paying less money to the state government as a percentage of your personal income than at any other time since the Washington State Economic and Revenue Forecast Council started recording it (see chart).

So, the next time you hear a business lobbyist complain that taxes are too high and that government is too big, remember their motives. They are not paid to make Washington a better place to live and work, nor are they paid to make sure public services are effective and properly funded. They are paid by corporations to keep their taxes low and to protect special-interest tax loopholes. That’s why, above all their legitimate concerns about underfunded transportation and higher education systems, they will continue to bang the Tea Party’s drum against “big government” and ignore all evidence to the contrary.

To close, or not to close, tax loopholes

It is in this context that the Legislature attempts to reconcile three competing budget proposals before the 2013 session ends on Sunday, April 28. Proposals from Gov. Jay Inslee and the House of Representatives attempt to reverse the course of budget austerity by taking modest steps to raise some revenue, largely by closing a few tax loopholes.

The Senate budget avoids closing any tax loopholes — and actually creates 15 new ones — by making more budget cuts and assuming phantom savings and efficiencies. Reports indicate that at least $300 million in the Senate budget comes from “a series of guesses about how much money can be saved and how much in extra taxes can be collected without specific directives or changes in the law.”

“It is time to apply common sense to closing tax loopholes that don’t strengthen our educational system, our communities, or our economic vitality,” Washington State Labor Council President Jeff Johnson said. “The Governor’s budget and the House budget represent a good first step towards moving our state in the direction of shared prosperity.”

CRC deal paves way for transportation

Until Friday, the state transportation budget was experiencing something of a hostage crisis. State Senators opposed to plans for the new Columbia River Crossing for I-5 connecting Vancouver and Portland — largely because of the inclusion of light rail in the project — were blocking progress on passing a transportation budget for the entire state.

The logjam led the News Tribune to editorialize: “Lawmakers in Olympia shouldn’t let the Puget Sound Gateway Project (connecting SR 167, I-5 and SR 509) become hostage to lunacy in Vancouver. If people in Clark County are willing to kiss off a new bridge and that much federal and Oregon money, so be it. In this part of the state, we know a good thing when we see one — and we aren’t quarreling over our need for the Gateway.”

The logjam led the News Tribune to editorialize: “Lawmakers in Olympia shouldn’t let the Puget Sound Gateway Project (connecting SR 167, I-5 and SR 509) become hostage to lunacy in Vancouver. If people in Clark County are willing to kiss off a new bridge and that much federal and Oregon money, so be it. In this part of the state, we know a good thing when we see one — and we aren’t quarreling over our need for the Gateway.”

But last Friday, the Senate Transportation Committee succeeded in passing a budget after a deal was reached on the CRC. At the request of Sen. Don Benton (R-Vancouver), the CRC project will be audited by the state’s Joint Legislative Audit and Review Committee to “investigate fraud, malfeasance, and misuse of public funds.” Plus, $81 million towards CRC planning will be frozen until the Coast Guard approves its design, addressing concerns about the bridge’s planned height.

However, that budget plan and the one already approved in the House are separate from the broad transportation proposal to increase gas taxes and some vehicle fees to cover the costs of several of the state’s transportation projects, including the $450 million needed to pay Washington’s share of the $3.4 billion CRC project. Oregon lawmakers have already committed to paying their share, as has the federal government.

GOP still fighting to cut workers’ compensation

There are still serious concerns that, as part of last-minute deal-making, legislators will consider resurrecting dead legislation to cut workers’ compensation benefits and give employers more control over injured workers. The labor committee in the Republican-controlled Senate just scheduled a hearing for today (Wednesday) to talk (again) about expanding the controversial lump-sum settlements for injured workers.

Less than 18 months ago, the Legislature approved dramatic changes to our workers’ comp system that haven’t even been fully implemented yet. Since then, some $300 million in savings — almost entirely from changes other than the lump-sum buyouts — have allowed the state to keep rates frozen for both 2012 and 2013, plus shift $82 million into reserves this year. Rather than making last-minute deals to expand the lump-sum buyouts, the responsible course is to allow the 2011 changes to be fully implemented, measure the impact on system costs and outcomes for injured workers, and then reassess the need for further changes. (Also see: “Four Reasons Why Our Current Workers’ Compensation System WORKS.”)

Less than 18 months ago, the Legislature approved dramatic changes to our workers’ comp system that haven’t even been fully implemented yet. Since then, some $300 million in savings — almost entirely from changes other than the lump-sum buyouts — have allowed the state to keep rates frozen for both 2012 and 2013, plus shift $82 million into reserves this year. Rather than making last-minute deals to expand the lump-sum buyouts, the responsible course is to allow the 2011 changes to be fully implemented, measure the impact on system costs and outcomes for injured workers, and then reassess the need for further changes. (Also see: “Four Reasons Why Our Current Workers’ Compensation System WORKS.”)

Please call the Legislative Hotline at 1-800-562-6000 and leave a message for your State Representatives, your State Senator and Gov. Jay Inslee: “No more cuts in the workers’ comp system!”