OPINION

$2-plus billion ‘problems,’ but an imminent rate hike ain’t one

By DAVID GROVES

By DAVID GROVES

OLYMPIA (June 19, 2013) — “Without this bill, there would be a $2.2 billion tax increase on employers over the next 10 years.”

That’s what Sen. Janéa Holmquist Newbry (R-Moses Lake) told the Columbia Basin Herald last week about SB 5127 regarding workers’ compensation. The Washington State Labor Council, AFL-CIO called that “bad information” that is “based on a fantasy scenario from a year ago, which was based on numbers from a year before that, that assumed no economic recovery.”

But now, a corporate lobbying blog called Washington State Wire (WSW) has stirred the pot by mischaracterizing both the senator’s quote and the Labor Council’s criticism of it. In doing so, this blog aims to turn a disagreement between a union organization and a Republican legislator — not exactly “man bites dog” territory when it comes to newsworthiness — into something of a scandal.

In yesterday’s blog posting, the WSW’s Erik Smith tellingly avoids Sen. Holmquist Newbry’s actual quote about a $2.2 billion tax increase, which was printed verbatim in the Labor Council one-pager in question. Instead, the WSW reported that the Labor Council criticized the senator for “warning fellow lawmakers of a $2.2 billion shortfall in the state workers’ comp program” during a floor speech.

In yesterday’s blog posting, the WSW’s Erik Smith tellingly avoids Sen. Holmquist Newbry’s actual quote about a $2.2 billion tax increase, which was printed verbatim in the Labor Council one-pager in question. Instead, the WSW reported that the Labor Council criticized the senator for “warning fellow lawmakers of a $2.2 billion shortfall in the state workers’ comp program” during a floor speech.

The WSW, a news blog funded by corporate groups like the AGC and managed by the Government Affairs Director of the Washington Business Alliance, then cites the state Department of Labor and Industries (L&I) as the source of that $2.2 billion figure, accuses the Labor Council of lying about the figure’s accuracy, and concludes that in Olympia “saying something that isn’t so — that’s something that just isn’t done.”

Tax increase vs. Shortfall vs. Target

For starters, there’s a big difference between a $2.2 billion tax increase and a $2.2 billion shortfall. And in this case, it’s the difference between an invoice and an estimate — for something the state might never have to do. This $2.2 billion is neither a tax increase nor a shortfall.

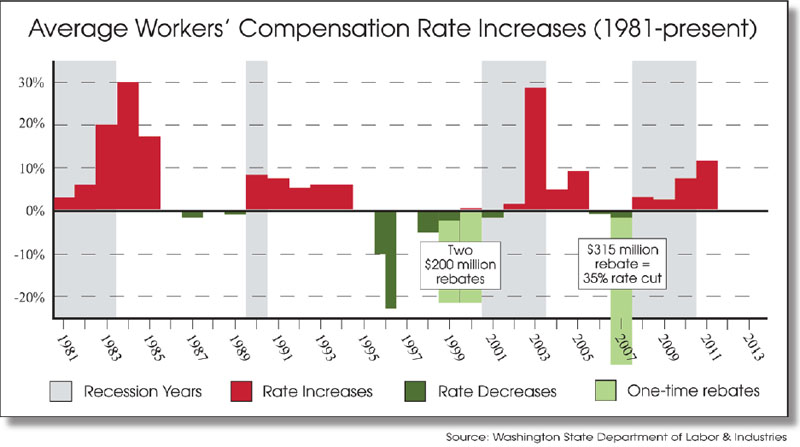

A year ago this month, the Workers’ Compensation Advisory Committee (WCAC), a group of business and labor stakeholders, asked L&I to present theoretical financial scenarios for rebuilding the system’s reserves to ensure the system’s long-term financial health. The worst-case scenario L&I presented at that June 2012 meeting envisioned building system reserves up to $2.3 billion, a level high enough that it would have almost no chance of running out, while also significantly lowering the projections for investment earnings from the billions of dollars in those workers’ comp funds. Under this scenario, L&I would have to increase rates 19% for 10 years.

After that meeting, WSW’s Smith breathlessly reported about the looming “mother of all rate hikes” to cover a $3.1 billion “budget gap.” Naturally, the business lobbyists Smith invited to comment were less than enthusiastic about the prospect. And naturally, the echo chamber of corporate lobbying groups and right-wing public policy think tanks began repeating the WSW’s alarming report, helping it make the transition from blog posting to legislative talking point.

But check the first comment under that June 2012 WSW article. It’s written by then-L&I Director Judy Schurke, complaining that Smith had mischaracterized the meeting. She wrote:

L&I is NOT contemplating a 19 percent increase nor did we say we need to ‘beef up’ the contingency reserve to $2.3 billion. Further, L&I does not have a budget gap of $3.1 billion.

And sure enough, just a few months later, L&I announced that there would be no rate increase in 2013, for the second straight year.

Fast forward a year. The economy has continued to improve, as has the system’s financial condition. L&I just reported that the system ran an operating surplus in the second half of 2012 thanks to cost-saving efficiencies and higher investment earnings, and reserves went up 64% to $953 million. That puts reserves already very close to L&I’s actual bottom target range of 8.7% of system liabilities. We’re not yet where we want to be, but we’re getting there — without rate increases and without waiting 10 years — just an improving economy and efficiencies at L&I.

But that good news is inconveniently timed for conservative lawmakers pushing another benefit-cutting workers’ compensation bill in the middle of the 2013 legislative session. In order to maintain a sense of urgency to pass their bill, they continue to insist that L&I must hit those WCAC targets for reserves and lower earnings projections — which they say now equals $2.2 billion — and the only way the state can accomplish that is by raising employers’ rates. Never mind that it is already happening right now without raising rates.

(It’s also worth noting that $2.2 billion figure presciently includes $400 million in lowered expectations for cost savings from the new lump-sum settlements program, although L&I has yet to formally announce this change. UPDATE (June 19): L&I announced at today’s WCAC meeting that the lump-sum settlements aren’t saving as much as advertised and it would transfer $242 million from reserve funds to cover the difference. See WSLC President Jeff Johnson’s statement in response.)

What L&I’s Schurke said a year ago remains true; there is no “budget gap” or “shortfall” of $2.2 billion at L&I. There is a target for building reserves and an actuarial recommendation that L&I lower earnings projections. But every year those targets are adjusted, and every year they are weighed against the prudence of increasing tax rates to achieve them. For the past two years, even though the system was in far worse financial condition than it is today, L&I has chosen not to raise rates.

Maybe that’s why the WSW’s Erik Smith now calls it L&I’s “2-plus billion problem,” as opposed to budget gap or shortfall. But in her comments to the Columbia Basin Herald, Sen. Holmquist Newbry takes that rhetorical sleight of hand and makes a giant leap further by suggesting it’s actually an imminent $2.2 billion tax increase — you know, unless her bill gets passed.

The Labor Council called that “bad information.” It is.

“That’s actually a polite way of saying it’s an alarmist scare tactic and demonstrably untrue,” said Labor Council spokesman David Groves.

David Groves is Editor of The Stand and — FULL DISCLOSURE! — a staff member of the Washington State Labor Council, AFL-CIO. Contact him at david.groves@thestand.org.