OPINION

Senate GOP moves to shield rich, corporations from state taxes

EDITORIAL

(Jan. 13, 2015) — On the first day of a state legislative session all agree will focus on how lawmakers can increase investment in education, transportation, mental health, eroding public employee wages and other priorities, Senate Republicans acted to shield industrial polluters and the state’s wealthiest 1% from having to pay for any of it.

With newly solidified control of the Senate, Republicans voted on party lines Monday to approve a new rule requiring a two-thirds majority vote in that body to enact any new taxes. Prior to the vote, Majority Floor Leader Joe Fain (R-Auburn) assured senators that the rule would not apply to existing taxes, such as sales, gas, and B&O taxes, but only to new sources of revenue.

That means just 17 senators can now block 147 state legislators from approving some proposals already on the table. Those ideas aim to shield low-income and middle-class Washingtonians from higher taxes, but still meet the state’s legal obligations, by targeting new taxes only to the state’s wealthiest people and to corporations that harm the environment.

As The Seattle Times points out, “The higher bar for tax votes would apply to two new revenue streams proposed by Gov. Jay Inslee: a capital-gains tax and a cap-and-trade plan aimed at carbon polluters.”

As The Seattle Times points out, “The higher bar for tax votes would apply to two new revenue streams proposed by Gov. Jay Inslee: a capital-gains tax and a cap-and-trade plan aimed at carbon polluters.”

Given the ideological opposition to taxes from Eastern Washington, Republicans will have no problem finding 17 senators from the most conservative third of the state to block any such proposals.

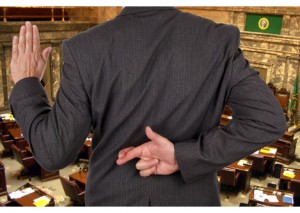

Democratic Sens. David Frockt, Andy Billig, and Bob Hasegawa said that imposing a super-majority requirement was in direct contradiction to the state constitution. The State Supreme Court has invalidated a Tim Eyman initiative’s attempt to erect the same hurdle.

Democrats also pointed out the irony that senators had just sworn their oaths to uphold the state constitution, but were immediately attempting to circumvent it.

“This question was taken on by our (state’s) founders when they wrote the constitution… all we are doing is implementing a tyranny of the minority,” said Sen. Hasegawa. “That’s all this is doing, just saying that one-third can block what is in the best interest of the State of Washington. This is a real fundamental question about the democracy we are operating under.”

Given the extraordinary budget challenges the state faces and the split control of the Legislature, compromise and middle ground must be found to address these critical issues. But as Sen. Billig pointed out, this rule change will make that task significantly harder and eliminate many options that should be debated from being seriously considered.

“This is about preventing members of the (GOP) majority from moving to the center to work on compromise,” Billig said, adding:

We have so many significant challenges facing our state right now. We’ve got a constitutional and moral obligation to fund basic education, we have a transportation crisis that demands our action, and many other challenges. In the history of our state, as we face challenges, the solutions have usually come from the political middle and this rule will make it more difficult to get that solution in the middle. This set of rules is a recipe for gridlock.

Sen. Frockt proposed amending the new GOP rule to require a two-thirds vote on the rule change itself, but Republicans rejected that proposal… with a simple majority.

In the recent years that Democrats controlled both chambers of the State Legislature, Democratic leaders’ budget and policy priorities were sometimes thwarted by a handful of their members who crossed the aisle to side with Republicans. But Democrats never responded by trying to change the rules. Can you imagine the outcry from the right had Democrats imposed a super-majority requirement on any cuts in social services or injured workers’ benefits?

It’s telling that the very first order of business by the slim new 25-23-1 majority of Senate Republicans is to erect barriers that protect the richest people and the biggest corporations from paying taxes.

Efforts to raise the revenue necessary for the state to meet its legal and moral obligations are now far more likely to target working families and small businesses. Plus, the nation’s most regressive tax system here in Washington, where the poor pay a greater share of their income in taxes than any other state, is more likely to stay that way. Or get even worse.