STATE GOVERNMENT

AG seeks criminal prosecution in Seattle wage theft case

The following is from the Office of the Attorney General:

SEATTLE (Feb. 10, 2015) — Washington State Attorney General Bob Ferguson has filed criminal charges in King County Superior Court against the owners and operators of West Seattle Athletic Club for stealing wages and evading taxes. In only the second wage theft criminal prosecution brought by the state, the Attorney General’s Office seeks justice for harmed workers and Washington taxpayers.

SEATTLE (Feb. 10, 2015) — Washington State Attorney General Bob Ferguson has filed criminal charges in King County Superior Court against the owners and operators of West Seattle Athletic Club for stealing wages and evading taxes. In only the second wage theft criminal prosecution brought by the state, the Attorney General’s Office seeks justice for harmed workers and Washington taxpayers.

Defendants Sam Adams and Dana Sargent are alleged to have engaged in theft and fraud totaling over $500,000. The defendants allegedly failed to pay state taxes, withheld wages from workers, failed to pay workers’ insurance premiums, and failed to pay unemployment insurance. (The charging documents can be found here and here.)

“Wage theft is a crime, and its victims are often among our most vulnerable residents. I won’t stand for violators who cheat working families out of their hard-earned wages,” said Attorney General Bob Ferguson. “My office will prosecute unscrupulous businesses that steal money out of the pockets of wage earners and taxpayers.”

“Wage theft is a crime, and its victims are often among our most vulnerable residents. I won’t stand for violators who cheat working families out of their hard-earned wages,” said Attorney General Bob Ferguson. “My office will prosecute unscrupulous businesses that steal money out of the pockets of wage earners and taxpayers.”

Owned Two Athletic Clubs in Washington

According to the charging documents, the defendants owned and operated six athletic clubs, four in Oregon and two in Washington, between 2012 and 2014.

One Washington location, Lincoln Plaza Athletic Club LLC in Tacoma, closed in 2013 due to unpaid retail sales tax.

The other Washington location, West Seattle Athletic Club LLC, closed in 2013, after which West Seattle Club LLC opened at the same location. This operation closed in October 2014 after the landlord evicted the defendants for unpaid rent.

Allegations of Theft and Fraud

The AGO alleges the defendants:

- Failed to pay the state approximately $446,000 in retail sales taxes that they collected for their Washington athletic clubs.

- Failed to pay 11 employees wages they rightfully earned totaling $7,166.

- Deducted insurance premium payments from employee paychecks, but failed to pay the insurance company, Aetna Healthcare. Aetna lost approximately $41,640 in unpaid medical and dental premiums, and workers were exposed to the risk of unpaid medical bills.

- Failed to pay over $35,000 into state unemployment insurance.

Criminal Charges Filed, Restitution Sought

The AGO has charged Adams and Sargent with:

- Five counts of Theft in the First Degree (Class B felony, 10-year maximum sentence);

- Three counts of Theft in the Second Degree (Class C felony, 5-year maximum sentence);

- Four counts of Filing a False or Fraudulent Tax Return (Class C felony, 5-year maximum sentence); and

- Nine counts of Theft in the Third Degree (gross misdemeanor, 364-day maximum sentence).

Sentencing guidelines indicate a potential sentencing range for the charges of 43 to 57 months. The AGO has alleged that aggravating circumstances are present in this case, which could lead to an upward departure from that range.

The AGO is also seeking full restitution for all of the victims involved including the State of Washington, the individual employees, and Aetna Healthcare.

Arraignment is scheduled for Feb. 18, 2015, in King County Superior Court.

The charges contained in the charging documents are allegations only. A person is presumed innocent unless and until he or she is proven guilty beyond a reasonable doubt in a court of law.

Commitment to Combating Wage Theft

Working families lose billions of dollars to wage theft each year, when crooked employers fail to pay legal minimum wages or overtime rates, require off-the-clock work, or simply bounce checks. Low-wage earners are particularly hard hit. One rigorous academic study of America’s three largest cities found that over two-thirds of workers in low-wage industries had experienced at least one pay-related violation in the previous week.

In 2012, the U.S. Department of Labor collected over $280 million in back wages on behalf of some 300,000 workers, but that still leaves millions more wage earners owed pay unjustly withheld from them. This was more than twice the amount of money stolen in bank, gas station, and convenience store robberies combined in that same year.

Under Attorney General Ferguson, the Attorney General’s Office has put an emphasis on combating wage theft in partnership with state agencies and county prosecutors. Additionally, the Attorney General recently proposed bipartisan legislation that would ensure the State of Washington does not do business with wage theft violators. The bill would prohibit businesses that have willfully or repeatedly violated the state’s wage payment laws during the past three years from receiving any contracts with Washington state. The prime sponsors of the legislation are Sen. Pam Roach (R-Auburn) and Rep. Sam Hunt (D-Olympia).

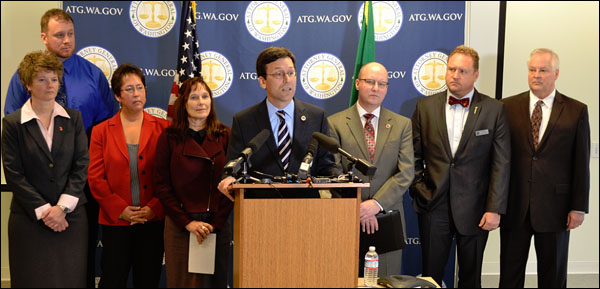

Announcing the charges, (from left) Annette Taylor of the Department of Labor & Industries, Gerrit Eades of the Employment Security Department, Nicole Ross of the Department of Revenue, Rebecca Smith of the National Employment Law Project (on behalf of the Washington State Coalition to Stop Wage Theft), Attorney General Bob Ferguson, Assistant Attorney General Scott Marlow, and from the Pacific NW Regional Council of Carpenters, Jimmy Haun and Alan Paja.

Cross-agency Coordinated Effort

The AGO Criminal Justice Division conducted the investigation in conjunction with the Washington State Department of Revenue, Office of Insurance Commissioner, the Employment Security Department and Department of Labor & Industries, as well as the United States Bankruptcy Trustee and the United States Department of Labor.

“We’re doing everything possible to make sure these employees get the wages they’ve earned,” said Washington State Labor & Industries Director Joel Sacks. “Every worker expects to get paid when they put in a day’s work. It’s the law. When a worker doesn’t get a paycheck, it’s frustrating and can mean bills don’t get paid or they don’t have money to put food on the table.”

Vikki Smith, Washington State Department of Revenue’s acting director, said “The defendants’ actions amount to taking nearly $500,000 in tax dollars that should be helping fund schools, public health, law enforcement and protections for children and seniors. Ninety-seven percent of businesses pay their taxes on time and in full. Adams and Sargent flagrantly disregarded the law and should be held fully accountable for their actions.”

“Health insurance is a benefit afforded to all citizens under the Affordable Care Act,” Washington State Insurance Commissioner Mike Kreidler said. “It is not OK to collect employees’ health insurance premiums and leave them high and dry when they need medical care. We are happy to support Attorney General Ferguson’s efforts to recover what these employees and Aetna are owed.”

Assistant Attorney General Scott Marlow and AGO investigator Lisa Gilman are leads on this case.

King County Prosecutor Dan Satterberg and Pierce County Prosecutor Mark Lindquist granted the AGO concurrent authority to prosecute this case.

How to File Wage Theft Violations with the State Department of Labor & Industries

If you believe you are a victim of wage theft, immediately file a complaint with the Department of Labor & Industries (L&I). Preserve any pertaining documentation regarding the amount of wages you believe you are owed.

Workers can file a wage complaint if a business does not pay them. Workers can also file a complaint if the business denies other workplace rights that are regulated by L&I, such as meal and rest breaks, overtime, and family care.

Individuals can download a Worker Rights Complaint form (F700-148-000) or they can go to their nearest L&I office to get one. Either way, they should mail the completed form or deliver it in person to the nearest L&I office. Find out more about how to file a worker rights complaint here.