STATE GOVERNMENT

Senate GOP millionaires oppose raising taxes—on themselves

The following is from Fuse:

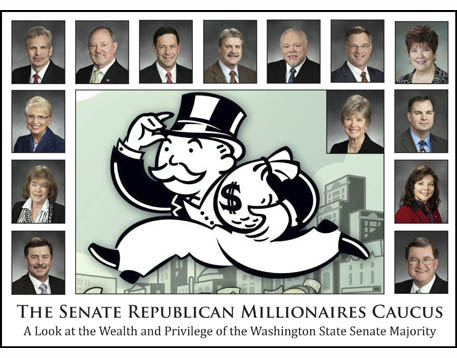

(June 1, 2015) — A detailed new analysis of public records shows that at least half of the Senate Republicans — 14 in total — have a net worth of $1 million or more. Despite having benefited the most from our schools, roads, and other public infrastructure, they continue to cling to an anti- tax platform that has caused those public investments to crumble.

In particular, the Senate Republicans — led by multi-millionaire Andy Hill — have steadfastly opposed a capital gains tax on the wealthiest few to fund education. The Senate Republicans’ opposition to this proposal is particularly noteworthy given that many of them could be subject to a capital gains tax, depending on how they choose to liquidate their extensive assets. Rather than building a Washington that works for everyone, the “Millionaires Caucus” has undermined the same pathways to opportunity they traveled themselves.

In particular, the Senate Republicans — led by multi-millionaire Andy Hill — have steadfastly opposed a capital gains tax on the wealthiest few to fund education. The Senate Republicans’ opposition to this proposal is particularly noteworthy given that many of them could be subject to a capital gains tax, depending on how they choose to liquidate their extensive assets. Rather than building a Washington that works for everyone, the “Millionaires Caucus” has undermined the same pathways to opportunity they traveled themselves.

The 2015 Members of the Republican Millionaires Caucus:

1. Sen. Linda Evans Parlette ($5,709,123)

2. Sen. Andy Hill ($3,818,740)

3. Sen. Tim Sheldon ($3,075,260)

4. Sen. Steve Litzow ($2,808,236)

5. Sen. Don Benton ($2,573,610)

6. Sen. John Braun ($2,276,903)

7. Sen. Bruce Dammeier ($2,267,055)

8. Sen. Mike Hewitt (1,945,190)

9. Sen. Mark Schoesler (1,754,311)

10. Sen. Jan Angel ($1,350,351)

11. Sen. Sharon Brown ($1,292,446)

12. Sen. Judy Warnick ($1,221,851)

13. Sen. Pam Roach ($1,075,238)

14. Sen. Curtis King ($1,003,337)

Government Of the Millionaires, By The Millionaires, And For The Millionaires

No one becomes wealthy in isolation. We all rely on the schools, roads, and public infrastructure that are the foundation of our economy. The financial success of the Senate Republicans shows that they have reaped great benefits from these public goods. Yet after earning incredible wealth, they are now making it more difficult for families across Washington to achieve prosperity and economic security as well.

The Washington Supreme Court has ordered the legislature to invest billions of dollars more into our K-12 public education system. In addition, this spring’s Elway poll showed that for the first time in six years, voters named education as the “most important” issue for the Legislature to address this year. Yet after earning incredible wealth, they are now making it more difficult for families across Washington to achieve prosperity and economic security as well.

Despite this broad public support and legal mandate, the Republican-controlled Senate has headed in the opposite direction. Instead of adding new revenue to fund education, Sen. Andy Hill and the Senate Republicans have relied on budget gimmicks and redirecting marijuana taxes away from voter-approved public health programs. This plan has been broadly condemned by editorial boards as “smoke-and-mirrors budget tactics”, “a shell game”, and “rely[ing] on likely unsustainable gimmicks and fund transfers.”

On the other side, progressive leaders in the state House have stepped up to address our “paramount duty” to fund education by proposing a capital gains tax on the wealthiest Washingtonians. Notably, 42 other states already tax the sale of stocks and bonds, and Washington’s capital gains tax rate would be among the lowest of Western states. A capital gains tax would provide our schools with a long-overdue, sustainable source of new revenue that would help ensure all our state’s students have the opportunity to succeed.

Unfortunately, Sen. Andy Hill and his Republican colleagues have widely rejected all calls for new revenue to fund education. Recently, Hill went so far as to call a progressive capital gains tax “unconscionable.” The Senate Republicans’ opposition to this proposal is particularly noteworthy given that as many as a majority of them — 14 — could be subject to a capital gains tax, depending on how they chose to liquidate their extensive assets.

Beyond the capital gains tax, the Millionaire Caucus has blocked efforts to increase the minimum wage, pass paid sick leave, require equal pay for women, give state workers a raise, and allow home health care workers to earn retirement benefits, just to name a few. They have consistently opposed legislation that would give working people the opportunity to support their family and improve their economic security.

Fuse also analyzed the finances of the Senate Democrats and found the story to be quite different on the other side of the aisle. Just nine of 23 of the Senate Democrats have assets of $1 million or more: Frockt, McAuliffe, Mullet, Nelson, Fraser, Pederson, Jayapal, Rolfes, and Billig. More importantly, those members support making the wealthy pay their fair share to fund education, as well as supporting paid sick leave, raising the minimum wage, and other economic security measures.

Read the entire report here at FuseWashington.org.