OPINION

Go bold: Double I-1366 tax cut with progressive tax reform

By JOHN BURBANK

(Nov. 18, 2015) — The polls may tell us we’re divided on who to vote for, but in our hearts, I think we all want similar things: to ensure kids can get a strong start in life, to have a college degree or a professional trade to be within everyone’s reach, to have clean and safe places to play, and to live in safe and vibrant neighborhoods.

No one can get those things all alone, by themselves. That’s why public budgets exist — to plan for today’s shared priorities, for our future needs, and for the unexpected. And taxes allow a community to pay for those public goods and services for which it has planned.

No one can get those things all alone, by themselves. That’s why public budgets exist — to plan for today’s shared priorities, for our future needs, and for the unexpected. And taxes allow a community to pay for those public goods and services for which it has planned.

The latest Tim Eyman Initiative, I-1366 (which just squeaked by with a 51% yes vote) could threaten all of that — but only if we let it.

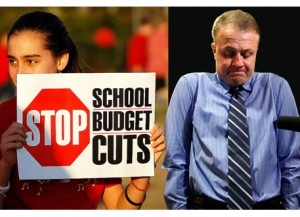

I-1366 says the Legislature has to do one of two things: either reduce the sales tax by 1 penny — which would, over the next six years alone, cut $8 billion from K-12 and higher education, mental health services, foster care and more — or, vote for a constitutional amendment that would give a tiny minority of legislators (17 out of 147) the power to effectively stop any future tax reform or changes to the state tax code, including closing corporate tax loopholes.

There are four ways our state legislators can respond. Only one really has any hope of helping.

1) They can do nothing and hope that the State Supreme Court finds I-1366 unconstitutional. That is a hope, not a certainty.

2) They can vote to repeal the initiative — but that takes two-thirds vote of both houses, which is unlikely given the prolonged partisan showdown over the budget this past year.

3) They can vote to put the undemocratic constitutional amendment proposed by I-1366 on the ballot — but again, that takes two-thirds vote of both houses. Unlikely at best.

4) They can do Eyman one better, and double the sales tax decrease proposed in I-1366. Yes, you read that right. Here’s why — and how to do it responsibly.

Washington’s sales tax hits low- and middle-income people much harder than the wealthy, because people with less money have to spend more of it on the basics. Low income families contribute $1 out of every $8 they make for sales and excise taxes. Middle class families contribute $1 for every $13.The top 1% of families, those with more than a half a million dollars a year in income, contribute $1 for every $63.

So cutting the sales tax is a big help for middle class and working class family finances… but only if the lost revenue is replaced, so we can fund the public goods and services on which we all depend. Reduce the sales tax without adding a new source of revenue and you can forget about reducing class sizes in our elementary schools, or lowering tuition at our colleges. Same with improving health care for kids, stamping out forest fires, and keeping public parks open, to name just a few.

So, let’s take a lesson from our neighbors in Idaho and Oregon and 43 other states where people who receive more, pay more in taxes toward our community priorities — so all of us can have access to these public goods now and in the future: an income tax.

Here is a dead-simple way to do it: the Legislature entirely exempts the first $50,000 of income from taxation, then the tax steps up the income ladder, so the effective tax rate is zero for families at $50,000, 2% for families at $100,000 ($2,000 in taxes), 5% for $500,000 of income, and 10% for a million dollars or more of income.

Washington has a lot more wealthy people than most other states. They just don’t pay their share of taxes. This progressive income tax would fix that and bring in $7.5 billion a year. Combine that income tax with a 2-cent sales tax decrease, as opposed to Eyman’s 1 penny, and legislators will have lowered taxes on three out of four households in our state — and still be able to meet their duty to fund the foundations of economic opportunity and a prosperous economy here in Washington.

A bold legislature would take advantage of Initiative 1366 to pass this tax reform to benefit all of Washington’s residents. But will they be bold?

John Burbank is the executive director and founder of the Economic Opportunity Institute in Seattle. John can be reached at john@eoionline.org.