OPINION

We needn’t choose. We can have great transit AND fund schools.

By REP. JOE FITZGIBBON

(Aug. 17, 2016) — Last week, state Sen. Reuven Carlyle (D-Seattle) wrote an op-ed at PubliCola criticizing November’s Sound Transit 3 expansion package. He was dead wrong about Sound Transit expansion and about the financing thereof. Here’s why.

Senator Carlyle, who argued that ST3’s property tax expansion “consumes all the oxygen in the room” for other government services, laid out a false choice between our regional transportation infrastructure and our state’s ability to fully fund education. This does a disservice both to our region’s residents who have waited 40 years too long for a regional transit system and our state’s public school children, parents, and educators who have waited 40 years too long for full public education funding.

Senator Carlyle, who argued that ST3’s property tax expansion “consumes all the oxygen in the room” for other government services, laid out a false choice between our regional transportation infrastructure and our state’s ability to fully fund education. This does a disservice both to our region’s residents who have waited 40 years too long for a regional transit system and our state’s public school children, parents, and educators who have waited 40 years too long for full public education funding.

First, a quick detour into Washington state law surrounding the property tax.

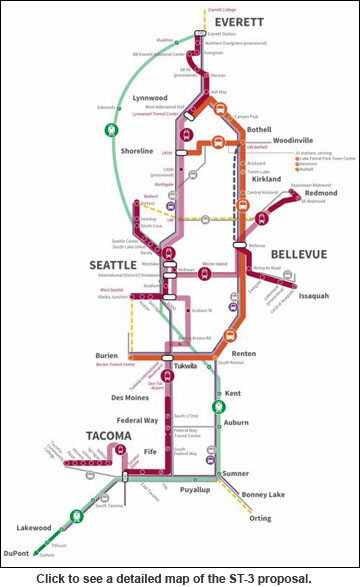

The state constitution caps property taxes at one percent of fair market value, or roughly $10 of tax per $1,000 of property value. And state law divides that $10 between $5.90 for cities, counties, and local taxing districts; $3.60 for the state (of which the state only currently uses $2.19); and an extra $0.50, colloquially known as “the gap,” in which a few additional taxing districts, deemed high priority public needs by the state, get their taxing authority. The 2015 legislation that then-representative Carlyle approved enacted an 11.9 cent per gallon gas tax increase to fund highway expansion across the state, and allowed Sound Transit several new revenue streams to fund light rail to Everett, Tacoma, Ballard, West Seattle, and Issaquah, including $0.25 in property tax capacity from .50 “gap” fund.

Several proposals have been floated since the McCleary decision came down that together get referred to as a “levy swap.” Former state representative House Appropriations Committee chair Ross Hunter originated the idea, which has since been proposed by 2012 gubernatorial candidate Rob McKenna and a suite of Republican senators in 2015. The essence of their idea is that the Legislature would increase the state levy from the $2.19 to somewhere between $3.20 and the max $3.60 and lower local school levies (which are not subject to the $10 cap, because they are voter-approved) commensurately.

The key here is that none of these proposals included using the property tax capacity in “the gap” that the 2015 transportation package allocated to Sound Transit. There has not been a credible proposal for addressing McCleary that incorporated using any of the $0.50 currently allocated for Sound Transit, county emergency and medical services levies, affordable housing levies, and several other purposes the legislature has deemed over the years to be high enough priorities to be protected from the $5.90 cap reserved for other local taxing districts. If there is a proposal to use the $0.50 property tax gap for McCleary purposes, I haven’t heard of it yet.

Carlile asserts that our work in the legislature becomes “dramatically more complex” because of the Sound Transit 3 finance plan. I cannot understand what he means by that, unless he had a secret plan, as a member of the senate minority, to go beyond the levy swap idea already rejected by governor Inslee and House Democrats — to increase the state property tax beyond the $3.60 limit and use tax capacity in the $0.50 gap.

He repeatedly refers, particularly in his follow-up post on Sunday, to “transferring some key property tax authority from the state” and to “redirecting the property tax away from education.” To be clear — the $0.50 “gap” has never been considered to belong exclusively to the state and has never been used for education funding — except to the degree that the state’s approval is required for local governments to use it, as with any tax source.

Perhaps, despite the rules that literally separate the .50 gap fund that’s being used for Sound Transit 3 authority, from state education funding, Senator Carlyle’s point is simply that property taxpayers will reach a tipping point of not wanting to increase property taxes any more once ST3 is enacted, even if the reward is full funding of basic education.

Perhaps, despite the rules that literally separate the .50 gap fund that’s being used for Sound Transit 3 authority, from state education funding, Senator Carlyle’s point is simply that property taxpayers will reach a tipping point of not wanting to increase property taxes any more once ST3 is enacted, even if the reward is full funding of basic education.

I have more faith in the voters of central Puget Sound than that. I believe we can walk and chew gum at the same time, that we can both build great transit and fully fund public schools, both long-overdue, badly needed public priorities.

But if I didn’t have that faith, the right time for me to have raised that objection would have been during the long, robust debate that happened in the Legislature during the long 2015 session over the transportation package. Both Sen. Carlyle and I had many opportunities, as members of the only legislative body with the ability to actually decide what Sound Transit’s taxing options would be, to suggest an alternative.

Sen. Carlyle claims he proposed some kind of business tax. I never saw that proposal from Sen. Carlile; I never saw him introduce legislation or language to that effect. But he did vote “yes” on a highway expansion package that won over urban legislators’ votes only by offering our communities a chance to vote to build a 21st-century transit network. (I voted “no” because I didn’t think it went far enough to transform the transportation paradigm and slowed our state’s progress towards fighting climate change.)

The package that the Legislature passed left Sound Transit with limited options. Sen. Carlyle criticizes Sound Transit for using a “lethargic 1990’s financing plan” — precisely the financing plan provided for them by the Legislature. In turn, Sound Transit lacks the legal option of coming up with a more creative plan. As Seattle Transit Blog noted in response to Sen. Carlyle’s broadside, “It’s a strange day when the cooks in the kitchen are upset that the diner orders off the menu they themselves wrote.”

The Legislature has been wrestling with education funding since statehood. It’s ridiculous to ask Sound Transit to wait even longer while we get our house in order (2017? 2018? Who knows?) before they embark on building the 21st century transit system our economy and growing population demand.

And at the end of the day, the Legislature has the legal ability to get creative in how we solve the education funding problem. We could pass a capital gains tax, close tax loopholes, enact a carbon tax, some smart combination of the above, or something totally different.

However, the Sound Transit Board cannot. They have only the options the Legislature, including the House Finance Committee chair, then-Representative Carlyle, provided them. I don’t begrudge Sound Transit that choice, and I particularly don’t begrudge current and future transit riders of King, Pierce, and Snohomish counties the ability to choose a transit future that a gridlocked Legislature has failed to provide them so far.

So, while Sen. Carlyle tries to parse his position, saying he is not against funding light rail, but simultaneously is not supporting the ballot measure to fund light rail, I hope you’ll join me in in voting “yes” on ST3 this fall. And if the only body that has the ability to build a better tax structure in Washington state, the Legislature, chooses to do so, I hope you’ll join me in that fight, too.

State Representative Joe Fitzgibbon (D-West Seattle) serves as the chair of the Environment Committee. He also serves on the Finance Committee and Local Government Committee. This column was originally posted at PubliCola and appears here with the permission of the author.

State Representative Joe Fitzgibbon (D-West Seattle) serves as the chair of the Environment Committee. He also serves on the Finance Committee and Local Government Committee. This column was originally posted at PubliCola and appears here with the permission of the author.