OPINION

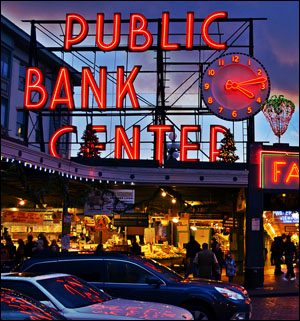

Address housing, city priorities by creating Seattle Public Bank

By JOHN M. REPP and CINDY COLE

(Nov. 30, 2016) — On Nov. 4, Seattle City Council member Kshama Sawant proposed legislation to allow socially responsible credit unions and community banks to manage the deposits of the city, deposits that are currently managed by Wells Fargo. Wells Fargo has been caught defrauding customers and has fired 5,300 of its lowest-paid workers, many who opposed the policies, while giving bonuses to the executives who ordered the fraud to be committed. Seattle can end its contract with Wells Fargo in 2018.

Then on Nov. 7, Sawant and 5 other Seattle City Council members proposed selling bonds to finance affordable housing in Seattle. Selling bonds means borrowing money from Wall Street banks and paying back the principal and interest to these same banks over the next 30 years.

Why is Seattle depositing our tax money in Wall Street banks, then paying them to borrow it back?

We propose that the City of Seattle charter its own bank, a public bank, which can not only manage the city’s deposits, but can expand the money available for locally needed projects like affordable housing through its loan portfolio. The Seattle Public Bank would be a banker’s bank and would partner with local credit unions and community banks, guaranteeing their loans for the needed projects or buying their loans so they can make more loans.

We propose that the City of Seattle charter its own bank, a public bank, which can not only manage the city’s deposits, but can expand the money available for locally needed projects like affordable housing through its loan portfolio. The Seattle Public Bank would be a banker’s bank and would partner with local credit unions and community banks, guaranteeing their loans for the needed projects or buying their loans so they can make more loans.

The concept of public banking is a proven concept. Worldwide, 40 percent of banking is done through public banks. There has been a nationwide effort to create public banks at the state, county, and city level since the financial crash of 2008-09. However, locally the concept has been challenged on legal grounds by Washington’s Attorney General (AG) as well as Seattle’s Office of City Attorney (CA).

It must be said that the legal arguments put forward are very weak.

The AG answered the request for a legal opinion from state Rep. Jake Fey (D-Tacoma) on April 6, 2016, by writing: “state law probably does not authorize a charter city to create a bank because cities are not among the entities allowed to create banks under state law.”

State law RCW 30A.08.020 does not prohibit a charter city from creating a bank. It simply says “persons” or “natural persons” may create a bank. In addition, the banking law could be easily amended by the State Legislature to allow a chartered city to create a bank.

The CA wrote a confidential memo to the Seattle City Council members and then released another memo to the public on Dec. 4, 2015. He wrote: “The financial health of a municipal bank could be seriously impaired by any legal challenge to the ability of the City to establish a bank in the first instance…”

The city would be the only depositor in a municipal public bank, and the city would not withdraw its funds out of fear the bank would collapse as might be expected from individual depositors. We have always expected legal challenges from private banking interests. In addition, the loan portfolio of a Seattle public bank dedicated to local projects would not be affected by a legal challenge. The borrowers would still be under contract to pay back their loans.

The second type of legal challenge we can expect would be based on the Washington State Constitution. In 2011, the Washington State Treasurer said a public bank at the state level would violate the State Constitution. There are three clauses that say the credit of the state cannot be given to (private) individuals, companies, or corporations. (Article VII Section 5, Article VIII Section 7, and Article XII Section 9) All these clauses if interpreted literally seem to preclude public banking. But the real intent of the clauses is “to prevent state funds from being used to benefit private interests where the public interest is not primarily served.” (quoting Japan Line, Ltd. v. McCaffree , 88 Wn.2d 93, 98, 558 P.2d 211 (1977) )

Former Supreme Court Justice Phil Talmadge has expressed the same idea. With a public bank, “the state would get a full return on its asset.” It would receive back both the principal and interest on the loans it makes. That by itself should make clear that the public interest is being primarily served. Furthermore, the state and the city have long been lending money to small business for economic development, a practice considered constitutional.

In addition to the “profits” a public bank makes, its loan portfolio will create many good jobs. It must be repeated that a public bank works with local credit unions and community banks. The local financial institutions, which know best their local communities, will do the work of finding and evaluating the borrowing business. The public bank will then partner with the credit unions and community banks by buying the loans or issuing a letter of credit to insure the loans. After the crash of 2008-2009 community banks have faced new regulations which forced many to sell to larger Wall Street banks. For a time, this resulted in a credit shortage for small business. And we know small business creates most of the new jobs in our communities. Public banking is a jobs program.

Opponents of public banking would rather argue their case on legal grounds because the economic case for public banking is so strong. The economic benefits of a Seattle Public Bank to our city and its citizens will be huge, and the more of our city’s capital that can be invested in such a bank, the more the benefits will flow. To compare the risk of public banking to the risk of the current Wall Street model is like comparing blocks of granite to soap bubbles, especially if a Trump Administration deregulates Wall Street like we are hearing it might.

Opponents of public banking would rather argue their case on legal grounds because the economic case for public banking is so strong. The economic benefits of a Seattle Public Bank to our city and its citizens will be huge, and the more of our city’s capital that can be invested in such a bank, the more the benefits will flow. To compare the risk of public banking to the risk of the current Wall Street model is like comparing blocks of granite to soap bubbles, especially if a Trump Administration deregulates Wall Street like we are hearing it might.

Because the interest on a loan, for example to build affordable housing, comes back to the public bank rather than to a private Wall Street bank, the cost to the citizens of Seattle for affordable housing would be cut, maybe in half over 30 years. In other words, with the public banking model, twice as many affordable housing units could be built in our city. A public bank can also make loans during the down time of a business cycle, an advantage of a public bank over a private bank. Public banking is countercyclical.

Currently, the city of Seattle, in addition to the money it deposits in Wells Fargo in a checking account, puts its “savings” into Treasury bills and CD’s. This money would be the source of the capital to start a public bank. That public bank would be able to create new credit and invest it locally for real projects, again, like affordable housing. The current method just adds to the pool of money that feeds the financial bubbles and global market speculation. A public bank can put new money back into our local economy and create new jobs. This is not a utopian idea. The Bank of North Dakota is an example of a public bank that has a very high return on capital, over 18.5% in 2014. The current average return on T-bills and CDs in Seattle’s “savings accounts” is less than 1%.

Public banking officers will be civil servants on a civil service salary. The mission of the bank will be to strengthen the economy of Seattle, not to maximize the profits of private stockholders. The officers of the bank will evaluate the loans it makes based on the business model of the borrower. They will not be receiving massive bonuses and will not be on commission. They will not be incentivized to break the law as was the case with the officers of Wells Fargo and other Wall Street banks.

In conclusion, while we applaud the proposal of Councilmember Sawant to end the city’s contract with Wells Fargo and the understanding of the six Seattle City Council members that Seattle needs more affordable housing, we think a creating a Seattle Public Bank is the best way to accomplish those policies.

Learn more at www.seattlepublicbanking.org.

Cindy Cole retired from SEIU 925 and works with 925 active retirees. John M. Repp retired from Boeing and is a delegate for SPEEA/IFPTE 2001 on the Martin Luther King, Jr. County Labor County. This column is an open letter to the Seattle City Council delivered earlier this month and posted here with the authors’ permission. Both are active members of the Seattle Public Banking Coalition.

Cindy Cole retired from SEIU 925 and works with 925 active retirees. John M. Repp retired from Boeing and is a delegate for SPEEA/IFPTE 2001 on the Martin Luther King, Jr. County Labor County. This column is an open letter to the Seattle City Council delivered earlier this month and posted here with the authors’ permission. Both are active members of the Seattle Public Banking Coalition.