STATE GOVERNMENT

On Jan. 1, Washington state’s minimum wage will be $11

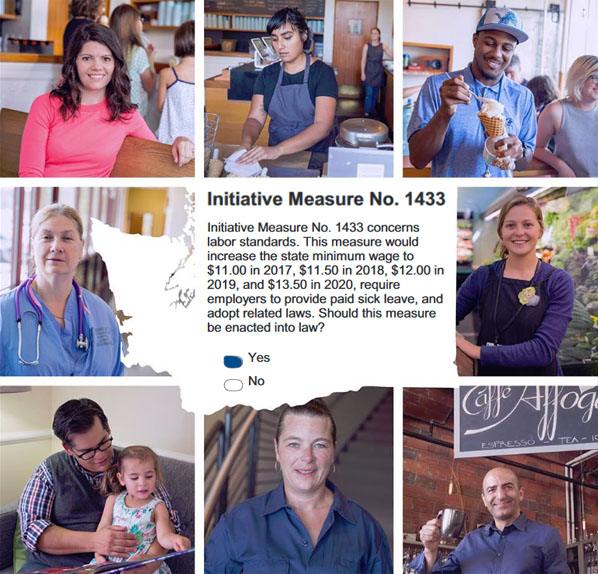

OLYMPIA (Dec. 6, 2016) — With the passage of Initiative 1433, the Washington State Department of Labor and Industries (L&I) officially notified employers and the public last week that the state minimum wage will increase from $9.47 to $11 an hour starting on Jan. 1, 2017. Higher minimum wage rates will apply to workers in Seattle, Tacoma, and the City of SeaTac (follow those links to determine the rates.)

OLYMPIA (Dec. 6, 2016) — With the passage of Initiative 1433, the Washington State Department of Labor and Industries (L&I) officially notified employers and the public last week that the state minimum wage will increase from $9.47 to $11 an hour starting on Jan. 1, 2017. Higher minimum wage rates will apply to workers in Seattle, Tacoma, and the City of SeaTac (follow those links to determine the rates.)

The new $11 minimum wage in 2017 is the result of I-1433, spearheaded by Washington unions and community groups, which was overwhelmingly approved by a 15-point margin in November’s election. If not for its passage, the state minimum wage would have increased just 6 cents. Instead, the $11 minimum wage applies to all jobs, including those in agriculture.

Under I-1433, Washington’s minimum wage will continue to increase to $11.50 in 2018, $12 in 2019, and $13.50 in 2020. In 2021 and thereafter, L&I will resume calculating annual inflationary adjustments, as it has since 1998.

Paid sick leave

Along with increasing the state minimum wage, I-1433 gives all workers in Washington state the opportunity to earn paid sick and safe leave starting Jan. 1, 2018. Under the measure:

An employee would get at least one hour of paid sick leave for every 40 hours worked, but employers could provide more generous paid leave. The measure would require employers to allow use of paid sick leave after 90 days of employment. Sick leave could be used to meet an employee’s own medical needs or to care for a family member’s medical needs. Family members would include: a spouse or registered domestic partner; a child; a parent, step-parent, or legal guardian; a grandparent; a grandchild; and a brother or sister. Paid sick leave could also be used when the employee’s place of business or their child’s school or childcare is ordered to be closed for a health related reason. Paid sick leave could be used for domestic violence leave.

L&I must adopt rules to enforce the new requirement, including, “…procedures for notification to employees and reporting regarding sick leave, and protecting employees from retaliation for the lawful use of sick leave.” The official rulemaking process, which will include public comment opportunities, will take place in 2017. Click here to sign up for updates on that process from L&I’s Employment Standards Program.

What to do if you are denied the proper minimum wage or other worker rights

L&I enforces the state’s wage-and-hour laws. If you believe your workplace rights have been denied by such things as not receiving at least the minimum wage or proper pay for hours worked, being denied rest or meal breaks, or not being allowed to use paid sick leave to care for a family member, you can file a complaint online. L&I investigates all wage-payment complaints.

L&I enforces the state’s wage-and-hour laws. If you believe your workplace rights have been denied by such things as not receiving at least the minimum wage or proper pay for hours worked, being denied rest or meal breaks, or not being allowed to use paid sick leave to care for a family member, you can file a complaint online. L&I investigates all wage-payment complaints.

L&I provides materials to help employers inform workers about the minimum wage and their rights as workers. Employers are required to post L&I’s “Your Rights as a Worker” poster in the workplace. The poster has general information about employment issues. An optional, minimum-wage poster is also available for employers. Both are free from L&I.

More information on Washington’s minimum wage is available on L&I’s wage-and-hour webpage. You can also call 360-902-5316 or 1-866-219-7321.