NATIONAL

AFL-CIO calls for tax reform that works for working people

The following is from the AFL-CIO:

(April 18, 2017) — Today, Americans will fulfill our civic duty of paying taxes to a system that is far from perfect or fair. As Congress reportedly is working on a plan to reform it, the AFL-CIO has a simple framework for what a serious proposal should include, and what should not be included. These are the standards we will judge it by:

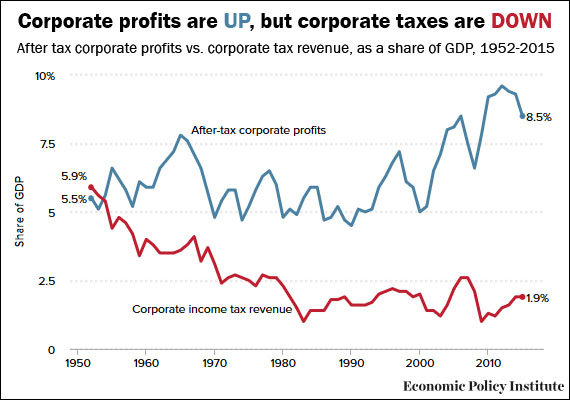

Big corporations and the wealthy must pay their fair share of taxes: Our rigged and broken tax system lets big corporations and the wealthy avoid paying their fair share of taxes (see chart below), sticking the rest of us with the tab. Any tax reform proposal must not cut taxes for big corporations or the wealthy. On the contrary, tax reform should restore taxes on the wealthiest estates and tax the income of investors as much as the income of working people. It’s imperative that tax reform make our tax system more progressive than it is now. Big corporations and the wealthy must pay more in taxes than they pay now, so we can build an economy that works for all of us.

Tax reform must raise significantly more revenue: Tax reform must raise enough additional revenue over the long term to create good jobs and make the public investment we need in education, infrastructure, and meeting the needs of children, families, seniors, and communities. Any tax reform that reduces revenues in the short term or the long term is unacceptable. Additionally, cost estimates must be honest and not rely on gimmicks that hide the true long-term cost of tax cuts.

Tax reform must eliminate the tax incentive for corporations to shift jobs and profits offshore: Taxing offshore profits less than domestic profits creates an incentive for corporations to shift jobs and profits offshore, while giving global corporations a competitive advantage over domestic corporations. Tax reform must eliminate the tax incentive for corporations to shift jobs and profits offshore, a move that would raise nearly $1 trillion over 10 years. Reform must not include a “territorial” system that further reduces taxes on offshore profits and would increase the tax incentive for global corporations to shift jobs and profits offshore. Tax reform must also encourage investment in domestic manufacturing, production, and employment to ensure a robust manufacturing sector.

Global corporations must pay what they owe on past profits held offshore: Global corporations owe an estimated $700 billion in taxes on the $2.6 trillion in past profits they are holding offshore. Tax reform should use these one-time-only tax revenues to increase smart public investment in infrastructure rather than cut corporate tax rates permanently. The higher the tax rate on these accumulated offshore earnings, the more funding will be available for public investment in infrastructure.