STATE GOVERNMENT

Coalition ‘disappointed’ in move to take capital gains off table

OLYMPIA (May 25, 2017) — All In For Action, a coalition of 50 organizations committed to cleaning up Washington’s upside-down tax code, issued the following response to Governor Jay Inslee’s comments on Tuesday that there is not sufficient support in the State Legislature to close the capital gains tax loophole:

OLYMPIA (May 25, 2017) — All In For Action, a coalition of 50 organizations committed to cleaning up Washington’s upside-down tax code, issued the following response to Governor Jay Inslee’s comments on Tuesday that there is not sufficient support in the State Legislature to close the capital gains tax loophole:

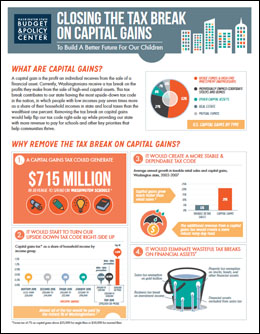

“The governor has been a strong advocate of fixing our state’s upside-down tax code that favors the wealthy at the expense of the rest of us,” said Misha Werschkul, Executive Director of Washington State Budget & Policy Center. “So we are disappointed in this outcome. Closing the capital gains tax break would have been a key long-term solution to helping provide the revenue our state needs to fully fund schools and to serve our communities. Legislators must continue to push for other solutions this legislative session that would help fix our state’s upside-down tax code, like closing wasteful tax breaks and making the real estate excise tax more equitable.”

“Hundreds of parents and allies have shown up to testify and advocate in Olympia, and thousands have called legislators, attended town halls, and visited legislators’ offices to demand ample funding for schools using new and progressive revenues. We intend to continue that work — because too many students in Washington state still aren’t getting the great education they were promised,” said Summer Stinson, Vice President of Washington’s Paramount Duty, a grassroots organization of parents and public school supporters advocating for the state to meet its constitutional “paramount duty” to fully fund K-12 education.

“Washington’s Paramount Duty continues to believe that our upside-down tax system is the root cause of our state’s consistent failure to meet the constitutional requirement to amply fund public schools with dependable and regular state tax sources,” added Stinson. “The only way to meet that requirement without destroying other social services, including those essential to helping children learn, is to close corporate tax loopholes and ask the wealthiest residents in our state to pay more — including through a capital gains tax.”

“Washington’s Paramount Duty continues to believe that our upside-down tax system is the root cause of our state’s consistent failure to meet the constitutional requirement to amply fund public schools with dependable and regular state tax sources,” added Stinson. “The only way to meet that requirement without destroying other social services, including those essential to helping children learn, is to close corporate tax loopholes and ask the wealthiest residents in our state to pay more — including through a capital gains tax.”

House Bill 2186, the House Democratic revenue proposal, calls for a 7 percent capital gains excise tax on the profit on the sale of stocks and bonds, affecting wealthy Washingtonians who have especially reaped the benefits of our state’s strong economy. This bill also calls for improvements in the Business and Occupation tax, eliminating some tax breaks, reforming the real estate excise tax, and implements marketplace fairness in Washington — and All In For Action urges legislators to pass these other revenue solutions as part the final budget.

The All In for Action coalition includes the Washington State Labor Council, AFL-CIO and a number of other labor organizations from around Washington state.