NATIONAL

Tell Congress: NO on Trump’s corporate tax giveaway

By DAVID GROVES

The Stand

WASHINGTON, D.C. (Sept. 13, 2017) — After failing in their campaign to repeal the Affordable Care Act and take away health care coverage for 23 million Americans — including 388,000 here in Washington state — President Donald Trump and Republicans in Congress are desperate for a legislative victory. Now they have teed up “tax reform” legislation.

WASHINGTON, D.C. (Sept. 13, 2017) — After failing in their campaign to repeal the Affordable Care Act and take away health care coverage for 23 million Americans — including 388,000 here in Washington state — President Donald Trump and Republicans in Congress are desperate for a legislative victory. Now they have teed up “tax reform” legislation.

That’s bad news for working people.

In an era of staggering wealth and income inequality, Trump and his allies want lower tax rates for big corporations and the wealthiest people in the country, including themselves. (Trump, who still refuses to release his personal tax returns, would get at least $125 million, according to this report.) Trust us, they say, this time the economic benefits will trickle down to the rest of you.

It gets worse. To pay for those unwarranted tax giveaways, they must make drastic cuts in programs that working people depend upon — including Medicaid, Medicare and Social Security — and further postpone desperately needed job-creating investments in our nation’s infrastructure.

TAKE A STAND — Just as working people stood up and defeated their attacks on health care, we can do the same with their upside-down “tax reform.” That effort begins today. The AFL-CIO is urging all union members and community supporters to click here to make a call to your members of Congress and tell them to reject wasteful tax giveaways for rich people and big corporations that don’t need them. Fill out the form and you’ll get a call back connecting you to your member of Congress to deliver that message.

TAKE A STAND — Just as working people stood up and defeated their attacks on health care, we can do the same with their upside-down “tax reform.” That effort begins today. The AFL-CIO is urging all union members and community supporters to click here to make a call to your members of Congress and tell them to reject wasteful tax giveaways for rich people and big corporations that don’t need them. Fill out the form and you’ll get a call back connecting you to your member of Congress to deliver that message.

A couple of weeks ago, House Speaker Paul Ryan (R-Wisc.) came here to Washington state to visit what Danny Westneat of The Seattle Times called “the most awkward spot in America to argue for corporate tax cuts:” The Boeing Company.

“Uh, Mr. Speaker?” Westneat wrote. “I hope you looked around on your Seattle visit. Because there’s probably no place where big business is less in need of a big tax break. And no company that’s already had more than its fair helping of them than Boeing.”

“Uh, Mr. Speaker?” Westneat wrote. “I hope you looked around on your Seattle visit. Because there’s probably no place where big business is less in need of a big tax break. And no company that’s already had more than its fair helping of them than Boeing.”

In Washington state, Boeing already gets a hefty break on its state tax bill, saving hundreds of millions of dollars per year — $262 million in 2016 and $305 million in 2015 — that would otherwise help pay for public schools, mental health services and other public priorities. In exchange, our state was supposed to get good Boeing jobs. Instead, the company has been trickling down pink slips. Boeing shed 6,344 jobs in the state in 2016 and is has already cut another 4,000 in 2017.

As for federal taxes, in recent years Boeing has actually had to pay some, but in nine of the past 15 years Boeing had so many tax writeoffs that the Chicago-based company had a negative tax rate and got refunds from the U.S. government.

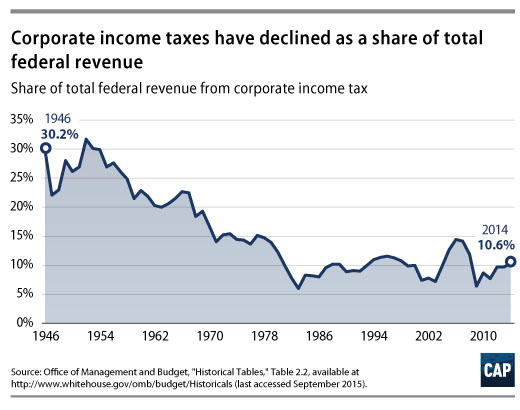

An analysis by the Center for American Progress shows that the tax reform plan outlined by House Republicans and championed by President Trump is “unlikely to benefit anyone other than corporations and the wealthy,” and that corporate tax receipts have already declined historically from roughly a 30 percent share of total tax receipts in the 1950s to about 10 percent in recent years.

An analysis by the Center for American Progress shows that the tax reform plan outlined by House Republicans and championed by President Trump is “unlikely to benefit anyone other than corporations and the wealthy,” and that corporate tax receipts have already declined historically from roughly a 30 percent share of total tax receipts in the 1950s to about 10 percent in recent years.

Enough. The bottom line is that big corporations like Boeing and the wealthiest people in this country do not need another tax cut. America’s working families have not experienced economic benefits from such tax cuts in the past, nor will they this time. Instead, in order to keep such cuts from dramatically increasing the budget deficit, Congress will have to make drastic cuts in programs that the 99% depend upon, like Medicaid, Medicare and Social Security.

Click here to make a call to your members of Congress and tell them to reject wasteful tax giveaways for rich people and big corporations that don’t need them!