NEWS ROUNDUP

10% fewer Boeing jobs | Jaime ‘good’ with tax plan | When unions are gutted

Monday, November 20, 2017

LOCAL

► In the (Everett) Herald — Aerospace workers adjust to changing industry — Their long, fruitful careers at the Boeing Co. came to an abrupt end this year. Gary Stone and Larry Lupescu are now helping other unemployed aerospace workers find new professional lives. There’s plenty to do on that front, given the thousands of local Boeing jobs that have moved away or disappeared during the past year… As of October, Boeing employed 66,242 workers in Washington. While that’s a huge number, it’s nearly 10 percent less than the 73,372 who worked for the company statewide a year earlier, according to online employment figures from the company.

► In the (Everett) Herald — Aerospace workers adjust to changing industry — Their long, fruitful careers at the Boeing Co. came to an abrupt end this year. Gary Stone and Larry Lupescu are now helping other unemployed aerospace workers find new professional lives. There’s plenty to do on that front, given the thousands of local Boeing jobs that have moved away or disappeared during the past year… As of October, Boeing employed 66,242 workers in Washington. While that’s a huge number, it’s nearly 10 percent less than the 73,372 who worked for the company statewide a year earlier, according to online employment figures from the company.

PREVIOUSLY at The Stand:

— Use state’s aerospace tax breaks to bring Airbus to Washington (by John Burbank, Oct. 19, 2017)

— Amid Boeing job cuts, legislators eye tax break accountability (May 3, 2017)

► In The Stranger — Seattle defends income tax in court, judge expected to rule next this week — If it can hold up in court, the tax will charge .25 percent on income above $250,000 ($500,000 for joint filers). The city would use the money to fund social services, reduce regressive taxes, or replace lost federal funding. In a state with the most regressive tax system in the country and a city that is particularly generous to the wealthy, passing the tax was a popular move for Seattle’s left. But the tax will faces court challenges, which will likely reach the state Supreme Court. Friday’s hearing was the first battle.

► In the Yakima H-R — Long dependent on immigrant workers, Yakima Valley growers laboring with new reality — After decades of enjoying a robust low-wage labor force mostly comprised of Mexican immigrants entering the U.S. illegally, growers here and across the state are finding fewer laborers interested in coming here to work. Increasing border security, Mexico’s improving economy and declining birth rate and anti-immigrant policy in the U.S. are all forces obstructing the once abundant flow of low-cost foreign labor into the country.

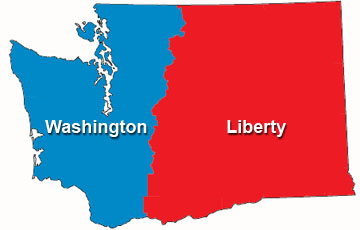

THIS WASHINGTON

► In today’s Spokesman-Review — Elway Poll shows rural, urban voters divided on issues, each other (by Jim Camden) — When politics gets boiled down to a fight of us vs. them, how the “us” believe the “them” think about “us” could be a key to elections. Or so a new survey of Washington voters by the Elway Poll seems to suggest. It looked at one of the most enduring features of the state’s political furniture, the Cascade Curtain, and which group of voters think other groups of voters regularly “diss” them. It also looked at the landscape for the 2018 congressional races and found some good indicators for Democrats in Western Washington. In Eastern Washington? Not so much.

► In today’s Spokesman-Review — Elway Poll shows rural, urban voters divided on issues, each other (by Jim Camden) — When politics gets boiled down to a fight of us vs. them, how the “us” believe the “them” think about “us” could be a key to elections. Or so a new survey of Washington voters by the Elway Poll seems to suggest. It looked at one of the most enduring features of the state’s political furniture, the Cascade Curtain, and which group of voters think other groups of voters regularly “diss” them. It also looked at the landscape for the 2018 congressional races and found some good indicators for Democrats in Western Washington. In Eastern Washington? Not so much.

► In the Columbian — Republican minority unfazed by ‘blue wall’ — “I’m in very good spirits,” said Sen. Ann Rivers (R-La Center), just days after the Democrats were poised to take control of the Senate. “I don’t really think it changes very much for me personally, because I have very strong relationships with (members of the Democratic and Republican caucuses in the House and Senate).”

► In the (Everett) Herald — Is the state Transportation Commission irrelevant? — A report says the citizen panel often is ignored, and its duties overlap with the Transportation Department.

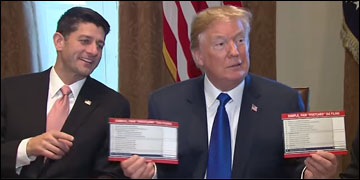

TAX CUTS FOR THE RICH

► In the (Longview) Daily News — Herrera Beutler defends tax vote — “I feel really good about it,” she said… An analysis by the Tax Policy Center, a centrist think tank, found that the House tax plan gives the largest tax cuts to higher-income households. But that wasn’t a problem for Herrera Beutler: “I don’t want to unfairly penalize anybody just because they’re rich.”

► In the (Longview) Daily News — Herrera Beutler defends tax vote — “I feel really good about it,” she said… An analysis by the Tax Policy Center, a centrist think tank, found that the House tax plan gives the largest tax cuts to higher-income households. But that wasn’t a problem for Herrera Beutler: “I don’t want to unfairly penalize anybody just because they’re rich.”

► In today’s Washington Post — With business booming, corporate owners push GOP for tax cuts — Republicans are acutely aware that if they fail to deliver on the tax overhaul it would upset the business interests that have long been key party allies, and donors.

► From HuffPost — Want a simpler tax code? Sure, but it’ll cost you. — Filing taxes will become much simpler – a pitch that finds a ready audience among Americans who view IRS Form 1040 with fear and loathing. An unadvertised side effect of this simplicity: The proposed tax plan moving through Congress disproportionately benefits the wealthy, shifting the tax burden down the income scale toward middle- and working-class taxpayers. And that, say critics of the plan, is kind of the point. “When Republicans say simplification for low-income households, they mean tax increases,” said William Gale of the centrist Brookings Institution. “When they say simplification for high-income households, they mean tax cuts.”

► From HuffPost — Want a simpler tax code? Sure, but it’ll cost you. — Filing taxes will become much simpler – a pitch that finds a ready audience among Americans who view IRS Form 1040 with fear and loathing. An unadvertised side effect of this simplicity: The proposed tax plan moving through Congress disproportionately benefits the wealthy, shifting the tax burden down the income scale toward middle- and working-class taxpayers. And that, say critics of the plan, is kind of the point. “When Republicans say simplification for low-income households, they mean tax increases,” said William Gale of the centrist Brookings Institution. “When they say simplification for high-income households, they mean tax cuts.”

► From TPM — GOP Sen. Collins: I haven’t decided whether I’ll vote for tax bill with ACA provision — Sen. Susan Collins (R-ME), who voted against the Senate’s previous effort to repeal the Affordable Care Act, on Sunday said she has not yet decided whether she will vote against a tax bill that includes a provision repealing ACA’s individual mandate, as Senate Republican leaders are proposing.

► In today’s NY Times — Dropping mandate won’t necessarily pay for the tax cuts — Americans dislike the requirement that everyone have health insurance. But eliminating it doesn’t mean that they’d stop buying coverage — or accepting subsidies.

► From TPM — Republicans learn the hard way: You break Obamacare, you own it — As Republicans in Congress inch towards striking what could be the biggest blow yet to the ACA — sticking a provision repealing the individual mandate into their tax bill — even some on the right are starting to sweat that the GOP will fully own the issue going forward. Said a grave-faced Sen. Lindsey Graham (R-SC):

“You can make an argument that Obamacare is falling of its own weight, until we repeal the individual mandate. I hope every Republican knows that when you pass a repeal of the individual mandate, it’s no longer their problem. It becomes our problem.”

► In today’s Seattle Times — Is uprising the only way out of gross inequality? Maybe so (by Jerry Large) — Runaway inequality isn’t inevitable, but the U.S. has chosen policies (regressive taxes, a limited social safety net, lax regulation of some big businesses) that make it an outlier, with one of the greatest disparities between the very wealthy and the rest of society. And right now, government at the highest levels is pursuing even greater inequality. If that doesn’t change, we’re headed for one kind of disaster or another.

► In today’s Seattle Times — Is uprising the only way out of gross inequality? Maybe so (by Jerry Large) — Runaway inequality isn’t inevitable, but the U.S. has chosen policies (regressive taxes, a limited social safety net, lax regulation of some big businesses) that make it an outlier, with one of the greatest disparities between the very wealthy and the rest of society. And right now, government at the highest levels is pursuing even greater inequality. If that doesn’t change, we’re headed for one kind of disaster or another.

THAT WASHINGTON

► From the Ralston Standard — U.S. stands alone as NAFTA talks resume — The president has followed through on campaign pledges to withdraw from controversial trade deals like the TPP. And he has made strident demands in talks with Canada and Mexico over tweaks to the NAFTA that appear to have imperiled the entire deal. The remaining 11 countries that were part of the TPP — including Canada and Mexico, as well as Japan — have taken steps toward the formation of a U.S.-less agreement. That could strengthen Canada and Mexico’s hand in the next round of NAFTA talks, scheduled to begin Friday in Mexico City.

► From the Ralston Standard — U.S. stands alone as NAFTA talks resume — The president has followed through on campaign pledges to withdraw from controversial trade deals like the TPP. And he has made strident demands in talks with Canada and Mexico over tweaks to the NAFTA that appear to have imperiled the entire deal. The remaining 11 countries that were part of the TPP — including Canada and Mexico, as well as Japan — have taken steps toward the formation of a U.S.-less agreement. That could strengthen Canada and Mexico’s hand in the next round of NAFTA talks, scheduled to begin Friday in Mexico City.

► From HuffPost — Thousands march on national mall to demand Puerto Rico disaster relief — Thousands gathered Sunday on the National Mall in Washington to demand the federal government increase its commitment to disaster relief on hurricane-ravaged Puerto Rico.

ALSO in The Stand — Donate to Operation Agua to help Puerto Ricans get safe water

NATIONAL

► From AP — Delaware officials say county can’t enact right-to-work law — Delaware’s Department of Justice says county officials lack the authority to enact their own right-to-work laws.

► From AP — Delaware officials say county can’t enact right-to-work law — Delaware’s Department of Justice says county officials lack the authority to enact their own right-to-work laws.

EDITOR’S NOTE — The anti-union Freedom Foundation attempted to pass local RTW laws here in Washington a few years ago, targeting cities and counties with conservative Republican leaders. But they failed and ended up being sued by the state Attorney General for failing to publicly disclose they were financing the effort.

► From The Nation — How the labor movement can win under national ‘right to work’ — Labor’s biggest gains have been made not when the law has been on our side but when workers have been most willing to stand up and fight.

TODAY’S MUST-READ

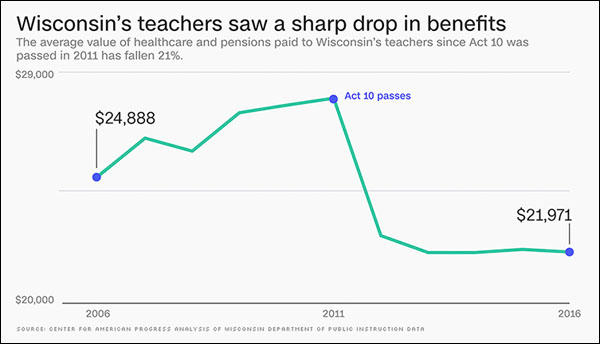

► From CNN — Here’s what happened to teachers after Wisconsin gutted its unions — Along with diminished leverage with school boards, teachers have seen lower pay, reduced pension and health insurance benefits and higher turnover as educators hop from one district to another in search of raises, a new report finds. With the Supreme Court preparing to hear a case that could make paying dues to unions voluntary for public sector employees — like they already are in right-to-work states — Wisconsin’s experience could soon confront teachers across the country as well. In the five years since Act 10 was passed, median salaries for teachers in the state have fallen by 2.6% and median benefits declined 18.6%, according to an analysis of state administrative data by the left-leaning Center for American Progress Action Fund.

The Stand posts links to Washington state and national news of interest every weekday morning by 10 a.m.