NATIONAL

U.S. is one of the least-taxed developed nations: analysis

The following is from the Institute on Taxation and Economic Policy:

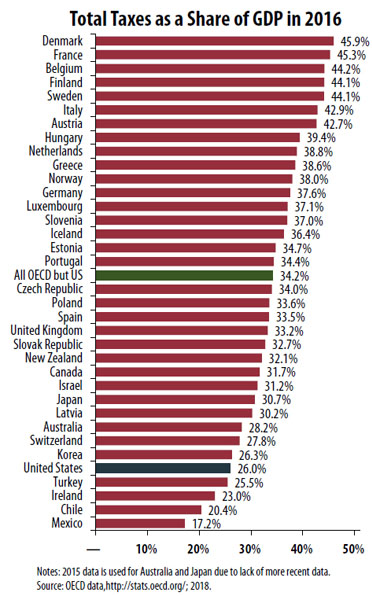

WASHINGTON, D.C. (April 13, 2018) — The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed of the developed nations.

The 35 OECD nations include most developed nations and the primary countries with which the United States trades and competes. According to the most recent data from the OECD, total tax revenue in the United States equaled 26 percent of gross domestic product (GDP) in 2016, which is another way of saying 26 percent of the nation’s economic output that year.

The 35 OECD nations include most developed nations and the primary countries with which the United States trades and competes. According to the most recent data from the OECD, total tax revenue in the United States equaled 26 percent of gross domestic product (GDP) in 2016, which is another way of saying 26 percent of the nation’s economic output that year.

Only Mexico, Chile, Ireland and Turkey collected less in taxes as a percent of GDP. Other OECD countries collect tax revenue equal to 34.2 percent of their GDP, on average. In fact, the United States could raise total collected tax revenue by 30 percent and remain below the OECD average.

The Trump Administration and members of Congress recently enacted the Tax Cuts and Jobs Act (TCJA) based on the premise that U.S. taxes were too high and that the path to economic prosperity is tax cuts. But most nations as economically developed as the U.S. collect far more in taxes, including countries with very successful economies. In reality, multiple factors beyond statutory tax rates contribute to a successful economy, including an educated, robust workforce, a strong education system, a healthy population and sound infrastructure.

ALSO at The Stand — Rally April 14 for tax system that works for all of us — We haven’t forgotten. In December, Donald Trump and congressional Republicans passed a $1.2 trillion tax cut for multinational corporations and their wealthy donors at the expense of working people across the country. Washingtonians are already familiar with this sad story — our state’s upside-down state tax code forces working families to pay 17 percent of their income in taxes, while the wealthiest among us get a special deal and only pay about 2 percent, stunting the improvements we can afford for our communities.

It’s time to create a tax system that works for all of us, and union members and community supporters of tax fairness are headed to the streets to ensure that both Olympia and Washington, D.C. hear their concerns.

TAKE A STAND! — Join us on Saturday, April 14 for “Tax Rally 2018: Invest In All Of Us” from 2 to 5 p.m. at Judkins Park, 2150 S. Norman St. in Seattle. Click here to RSVP and to volunteer with this important event.