STATE GOVERNMENT

Attend meetings July 19-23 to urge fairer state tax structure

OLYMPIA (July 10, 2018) — The Legislature has established a Tax Structure Work Group, the goal of which is to facilitate discussions about the current tax structure, with a focus on the Business & Occupation tax, and identify any options to improve the overall tax structure. The work group is scheduling public meetings to create an open discussion on Washington’s tax structure, and the Washington State Labor Council, AFL-CIO is urging union members and community supporters to attend. (See schedule below.)

Much was accomplished in the 2018 legislative session, but as WSLC Government Affairs Director Joe Kendo reported, legislators punted on the issue of our state’s upside-down tax system:

The Institute on Taxation and Economic Policy reports that people earning less than $21,000 per year pay nearly 17 percent of their income on state and local taxes in our state. Meanwhile, top earners making more than $500,000 a year pay an abysmally low 2.4 percent. This is because we rely on a sales tax that hits working families hardest to pay for vital public services — services that were deeply cut during the Great Recession. Coupled with hundreds of special tax breaks for corporations, working families are paying more and getting less out of their government.

The Tax Structure Work Group meetings, although focused on business taxes, are a great opportunity to weigh in on making our state’s upside-down tax system fairer for working people. Each meeting will include a brief presentation by staff on the tax structure, followed by a small group discussion and report out, and then public testimony. Including small group discussions is something new for the Legislature, so they are asking that folks register online in advance. Pre-registration is not required, but it will allow them to estimate attendance and properly prepare.

Here are the scheduled meetings (follow the links to pre-register):

SPOKANE: Thursday, July 19 from 9 a.m. to noon at the Historic Davenport Hotel, 10 S. Post St.

YAKIMA: Friday, July 20 from 1 to 4 p.m. at the Howard Johnson Hotel, 9 N. 9th St.

VANCOUVER: Monday, July 23 from 1 to 4 p.m. at Warehouse 23, 100 Columbia St., #102

For more information about the Tax Structure Work Group, click here.

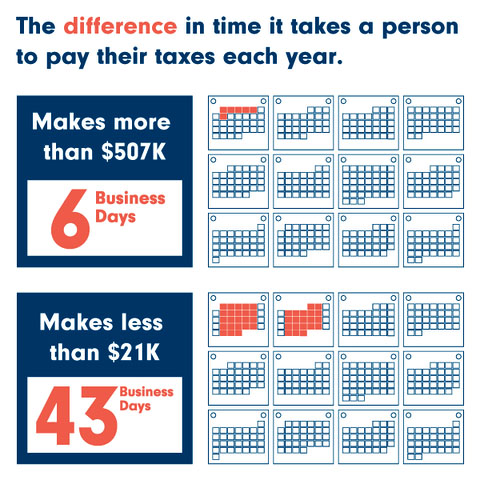

BACKGROUND — Six business days — that’s all the time the wealthiest households in Washington need to earn their share of state taxes for the entire year. Meanwhile, working families need more than two months to do the same.

BACKGROUND — Six business days — that’s all the time the wealthiest households in Washington need to earn their share of state taxes for the entire year. Meanwhile, working families need more than two months to do the same.

Washington’s in last place. We have the most upside-down, regressive tax code of any state in the country where the rich pay the least and the poor and middle class make up the difference. Our tax code asks working people to pay up to 17 percent of their income in state and local taxes while the wealthiest pay less than 3 percent. That’s because powerful special interests have riddled the tax code with wasteful tax breaks and loopholes that siphon money out of our communities.

It doesn’t have to be this way. If we work together, we can end wasteful tax breaks and ask the wealthiest to pay their share. With a tax code that works for all of us, we can invest in the foundations that build thriving communities across our state, like great schools, modern infrastructure, and affordable housing.