STATE GOVERNMENT

In 2019, let’s start balancing our tax code

This is the first edition of the weekly Legislative Update newsletter from the Washington State Labor Council, AFL-CIO. If you didn’t already receive it via email, subscribe to The Stand and you’ll get the Legislative Updates and all of the WSLC’s other legislative reports.

This is the first edition of the weekly Legislative Update newsletter from the Washington State Labor Council, AFL-CIO. If you didn’t already receive it via email, subscribe to The Stand and you’ll get the Legislative Updates and all of the WSLC’s other legislative reports.

OLYMPIA (Jan. 16, 2019) — The 2019 session of the State Legislature began on Monday. All indications are that the expanded pro-worker Democratic majorities — three additional Senate seats for a 28-20-1* advantage and seven more House seats for a 57-41 majority — will mean organized labor’s priority issues will get fair hearings and votes this year.

The Washington State Labor Council, AFL-CIO outlined many of those legislative issues last week when it released its 2019 Shared Prosperity Agenda. (View the one-pager in PDF – HTML formats.) This agenda includes many of the priority legislative efforts supported by WSLC-affiliated unions and community partners, but this list is not intended to be comprehensive. The WSLC will also be supporting other bills championed by its affiliates on a range of issues to address economic opportunity and justice.

The Washington State Labor Council, AFL-CIO outlined many of those legislative issues last week when it released its 2019 Shared Prosperity Agenda. (View the one-pager in PDF – HTML formats.) This agenda includes many of the priority legislative efforts supported by WSLC-affiliated unions and community partners, but this list is not intended to be comprehensive. The WSLC will also be supporting other bills championed by its affiliates on a range of issues to address economic opportunity and justice.

Stay tuned to this weekly newsletter and the regular State Government news at The Stand to track the progress of these bills as they are filed, heard and voted upon.

Balancing Our Tax Code

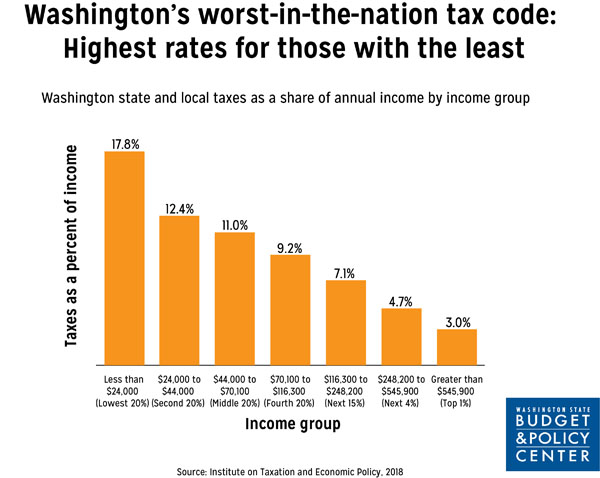

One of the priority issues on the WSLC’s Shared Prosperity Agenda is the critical need to balance our state’s upside-down tax code. Washington’s tax code has the infamous distinction of being the most unfair and regressive in the nation, meaning that the poorest among us pay the most in taxes and the wealthiest don’t pay their fair share. In our state, those making the least pay 18% or more of their income towards state and local taxes, while the wealthiest pay only 3% or less.

For years, there has been a lot of talk about balancing our tax system, but powerful special interests have fought to keep the system rigged in their favor while working families pay more and more.

So this year, the WSLC and many of its affiliated unions have joined the Balance Our Tax Code coalition. The WSLC will be supporting multiple legislative efforts including:

So this year, the WSLC and many of its affiliated unions have joined the Balance Our Tax Code coalition. The WSLC will be supporting multiple legislative efforts including:

Closing the capital gains tax break on sales of stocks/bonds and other special interest tax loopholes;

Reforming the Real Estate Excise Tax to make it more progressive so the sale of less expensive homes are taxed less and the sale of the most expensive homes are taxed more; and

Modernizing and expanding the state’s Working Families Tax Credit, our state’s version of the federal Earned Income Tax Credit, refunding some of the sales taxes low- and middle-income

Washingtonians pay.

You’ll be hearing much more detail about these and other efforts to Balance Our Tax Code all session long. In the meantime…

TAKE ACTION — Please sign this petition to support balancing Washington’s tax code to make it more fair for working families.

Register NOW for the WSLC Legislative Reception and Lobbying Conference

All union leaders, staff, and especially rank-and-file members are invited to attend the WSLC’s 2019 Legislative Reception and Lobbying Conference, which is set for Jan. 30-31 at the Hotel RL (Red Lion), 2300 Evergreen Park Dr. SW, in Olympia. Join us to learn more about the issues important to Washington’s working families and the state’s labor movement.

All union leaders, staff, and especially rank-and-file members are invited to attend the WSLC’s 2019 Legislative Reception and Lobbying Conference, which is set for Jan. 30-31 at the Hotel RL (Red Lion), 2300 Evergreen Park Dr. SW, in Olympia. Join us to learn more about the issues important to Washington’s working families and the state’s labor movement.

The Legislative Reception will be Wednesday, Jan. 30 from 6:30 to 8:30 p.m. at the hotel. This is a great opportunity for union members to meet and mix with legislators, other elected state officials, and agency directors and staff in an informal setting.

The following morning, Thursday, Jan. 31, the WSLC Lobbying Conference begins at the hotel at 8:30 a.m. — registration opens at 7:30 a.m. — with a brief legislative lobbying training and review of the most pressing issues facing working families, then delegates will take buses to the Capitol to meet with their legislators on these issues. Buses will bring delegates back to the hotel for lunch and a quick debriefing and be finished by about 2 p.m.

Register online. The $110 registration fee covers admission, drinks and hors d’oeuvres at the WSLC Legislative Reception on Wednesday night, plus lunch and materials for the WSLC Legislative Lobbying Day on Thursday. You can also register guests for only the Reception for $20/person. Preregistration is especially important because the WSLC will be making Thursday’s appointments with state legislators in advance, so if you plan to attend, sign up now!

If you have any questions, email Willa Kamakahi or call her at 206-254-4913.

* “Democrat” Sen. Tim Sheldon of Potlatch caucuses with the Republicans, so he’s the “1” in the 28-20-1 majority.