STATE GOVERNMENT

WSLC applauds House Democrats’ budget plan

OLYMPIA (March 26, 2019) — House Democrats released their 2019-21 operating budget proposal on Monday, which in addition to maintaining and improving critical state services, would also fund all state employee contracts and school employee health care coverage.

OLYMPIA (March 26, 2019) — House Democrats released their 2019-21 operating budget proposal on Monday, which in addition to maintaining and improving critical state services, would also fund all state employee contracts and school employee health care coverage.

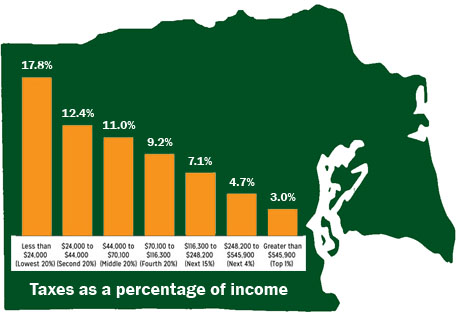

“Working families in Washington have been waiting to see a state budget that reflects their values but also does something about our state’s unfair, upside-down tax system. This House Democratic budget plan is it,” said Larry Brown, President of the Washington State Labor Council, AFL-CIO. “This proposal takes reasonable steps to ask the wealthiest people in this state to pay their fair share so that we can afford the things that citizens are demanding: quality public schools, improved behavioral health services, more affordable housing, and importantly, making a major investment in our state’s higher education and workforce training systems. The WSLC applauds this bold proposal that respects our hard-working state government and public school employees.”

Following are the highlights of the $52.6 billion two-year operating budget, as provided by House Democrats ( also watch the budget press conference on TVW):

Behavioral Health: The two-year House Democratic budget will make significant investments in continued efforts to fix the state behavioral health system. Highlights include:

- $91 million to expand community behavioral health beds & services.

- $136 million in this biennium to ensure the stability of our state hospitals and the safety of our patients and staff.

- $76 million in this biennium to comply with the Trueblood decision.

Affordable Housing: In addition to the state capital budget, the state operating budget invests in housing programs and services such as:

- $21 million focused on permanent supportive housing and youth homelessness.

- $13 million for the Housing and Essential Needs Program, which helps people with disabilities who are struggling to find or maintain housing.

Education: This budget proposal fulfills the bipartisan promise made by the Legislature to fund health care coverage for school employees through the School Employee Benefits Board (SEBB) program. This investment will cost $453 million in this budget and $1.1 billion over four years. Other education investments include:

- $70 million for additional special education funding ($153 million over four years).

- $77 million for additional levy assistance for areas with low-property values.

- $5 million additional funding for student mental health and safety.

Workforce Education Investment: The Workforce Education Investment dramatically expands programs Washington needs to ensure students are ready for the jobs of the future. It addresses demand through targeted investments by bringing together students, parents, higher education institutions, workers, and businesses.

- Expands access to the Washington College Grant (formerly the State Need Grant).

- Makes career pathways a priority by expanding programs that guide students through community and technical colleges or apprenticeships and increases counseling.

- Increases capacity at the public community and technical colleges and four-year institutions for high-demand programs, such as computer science, engineering, nursing, and other high-demand fields.

Other investments:

- $38 million to expand Early Childhood Education and Assistance Program (ECEAP) slots and rate increases.

- $62 million for rate increases for community residential services providers (long-term and developmental disabilities care).

- $24 million to improve habitat and protect Orcas.

- $11 million to eliminate the backlog in testing sexual assault kits.

- $13 million in state general funds (over $130 million in total) to increase our wildfire response and address natural disasters.

- $9 million to expand rural broadband.

While the state economy has resulted in additional revenue over the current two-year budget, existing expenses have outpaced that revenue growth. The state has an additional $5.8 billion of expenses over the last two-year budget, most of which ($3.9 billion) comes from the bipartisan education funding agreement reached in 2017. The state’s revenue growth in that same time frame was $4.5 billion. Therefore new revenue sources are needed to make critical investments in behavioral health, housing, higher education, and the environment.

House Democrats are proposing an Extraordinary Profits tax from the sale of stocks and bonds and other high valued assets, and changing the Real Estate Excise Tax (REET) rates for those selling property valued over $1.5 million.

“Washington state has the most upside down tax code in the country,” said Rep. Gael Tarleton, D-Ballard, chair of the House Finance Committee. “Wealth continues to concentrate in the hands of fewer and fewer individuals who pay less and less into public investments as a share of their personal wealth. This wealth is not generating revenue for the state. It’s time to start building a quality of life for everyone. The Extraordinary Profits Tax is a more balanced approach that will allow us to invest in K-12 schools, affordable housing, behavioral health services, and environmental protection.”

“Washington state has the most upside down tax code in the country,” said Rep. Gael Tarleton, D-Ballard, chair of the House Finance Committee. “Wealth continues to concentrate in the hands of fewer and fewer individuals who pay less and less into public investments as a share of their personal wealth. This wealth is not generating revenue for the state. It’s time to start building a quality of life for everyone. The Extraordinary Profits Tax is a more balanced approach that will allow us to invest in K-12 schools, affordable housing, behavioral health services, and environmental protection.”

For the wealthiest people in Washington who sell high valued assets like stocks and bonds for hundreds of thousands of dollars, the proposal would apply a 9.9% excise tax for profits over $200K for married filers.

Washington’s current Real Estate Excise Tax (REET) rate is a flat rate regardless of the value of the transaction. The Progressive Real Estate Excise Tax proposal unveiled today would result in approximately 80% of real estate sellers receiving a tax cut while another 18% would see no change in the rate. The remaining sellers, those selling real estate valued at $1.5 million or higher, would see a rate increase.