LOCAL

Stand up to construction industry tax fraud April 15 in Olympia, Seattle

We pay our taxes. Why don’t they?

An estimated $2.6 billion in Social Security, Medicare, state income and federal taxes went unpaid in the construction industry in 2017. Some 1.2 million construction workers were paid off the books by employers, while another 300,000 were misclassified as independent contractors, in part to avoid paying taxes.

The Pacific Northwest Regional Council of Carpenters and their allies will be speaking out against construction industry tax fraud at two events on Tax Day—Monday, April 15:

The Pacific Northwest Regional Council of Carpenters and their allies will be speaking out against construction industry tax fraud at two events on Tax Day—Monday, April 15:

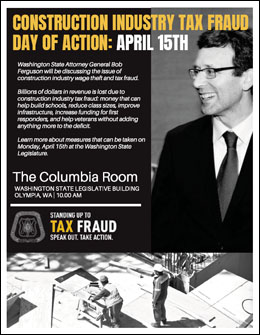

OLYMPIA — The Pacific Northwest Regional Council of Carpenters and their allies will be speaking out against tax fraud in the construction industry in Olympia on Tax Day, April 15. Join them and Attorney General Bob Ferguson and State Auditor Pat McCarthy at 10 a.m. on Monday, April 15 in the Legislative Building’s Columbia Room at the State Capitol in Olympia. Download the event flier.

SEATTLE — The action begins with a rally from 11:30 a.m. to 1 p.m. at 3rd and Union with several community and labor leaders speaking, including Washington State Labor Council President Larry Brown. That afternoon from 4 to 8 p.m. participants will be handbilling outside the post office there at 301 Union St.

The Day of Action events are two of more than 100 being organized by the United Brotherhood of Carpenters and Joiners of America (UBC) and its regional council affiliates in the U.S. and Canada, April 13-15. Learn more at StandingUpToTaxFraud.net.

“April 15 is the date when individual tax returns are due in the U.S.,” said Frank Spencer, UBC General Vice President. “However, throughout the industry, many crooked construction companies routinely fail to deduct and pay income and employment taxes on at least 1.5 million U.S. construction workers per year. Some 1.2 million workers are simply paid off-the- books. We will not sit idly by while crooked contractors and labor brokers steal jobs and commit fraud — fraud that rips off workers, good employers, our provincial, state and federal governments and taxpayers.”

The UBC’s best estimate, based on studies done at the state level, is that the underground economy in America’s construction industry, which includes failure to properly withhold state and federal taxes and underpayment of unemployment insurance and workers compensation premiums, costs those governments and worker safety-net programs some $148 billion annually. According to Statistics Canada, the residential construction industry there is the largest contributor to its underground economy, accounting for more than a quarter of the total, or $13.7 billion.

“Good employers and their employees shouldn’t lose work to crooked contractors who cheat on their taxes and insurance premiums and commit wage theft,” Spencer said. “The money being lost to tax fraud can be put to work fixing our infrastructure and building schools. It can care for our veterans, our kids, our security and our social safety net. It’s not just construction workers and law-abiding businesses who lose out, it’s everyone.”