NATIONAL

Trump plan to cut payroll taxes is ‘an attack on Social Security’

WASHINGTON, D.C. (March 10, 2020) — The following is a

WASHINGTON, D.C. (March 10, 2020) — The following is a

Donald Trump is using the coronavirus crisis as an excuse to propose a reduction in payroll contributions. This is a Trojan Horse attack on our Social Security system, which will do nothing to meaningfully address the crisis at hand.

Other proposals to stimulate the economy, such as restoring the Making Work Pay Tax Credit or expanding the existing Earned Income Tax Credit, are more targeted and provide more fiscal stimulus. They are fairer in their distribution and place no administrative burdens on employers.

The only reason to support the Trump proposal above those others is to undermine Social Security. This is true even if borrowed federal funds are substituted for Social Security’s dedicated revenue. Under the guise of stimulating the economy, Trump’s plan to reduce Social Security contributions would either undermine Social Security’s financing or employ general revenue, both of which would set the stage for future demands to cut Social Security.

At base, tax cuts do nothing to meaningfully address coronavirus, or even the resulting market panic. We do want to ensure people have the cash they need while they face massive uncertainties around employment and other costs. We want people to stay home as much as needed without having to worry about paying their rent or other costs. What we need most is a robust public health response, which the Trump Administration is utterly failing to provide.

Earlier this week, Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer released an excellent list of steps we should take to combat coronavirus. Their plan includes paid sick leave, free coronavirus testing, and treatment for all. Our government should enact these measures, not slash payroll contributions. And, for supporters of Social Security, their plan, unlike Trump’s, will not undermine this vital program.

ALSO TODAY from The Hill:

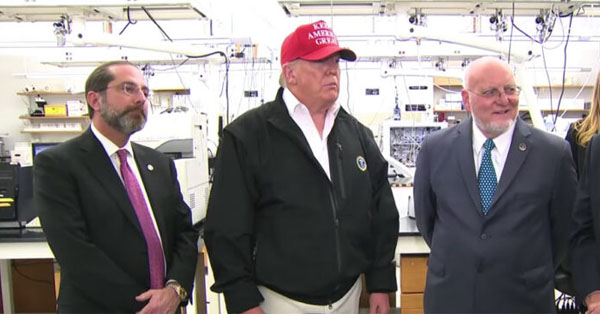

Trump pitches tax cut to ease panic — The president took his biggest step to address the economic fallout of the coronavirus, saying he will ask Congress to approve a payroll tax cut and relief for hourly workers.

EDITOR’S NOTE — “Payroll tax cuts” means a temporary reduction in workers’ contribution into the Social Security system. President Obama and Congress did this to try to stimulate the economy in the aftermath of the Great Recession in 2011 and 2012, cutting the Social Security tax paid by employees from 6.2 percent to 4.2 percent and backfilling the lost Social Security funding with general federal revenue. Naturally, when the cuts were due to expire, there was tremendous political pressure to make these temporary tax cuts permanent. By allowing them to expire, Obama faced political attacks for “raising taxes.”

Democrats balk at Trump’s payroll tax cut proposal — Democrats argued that cutting the federal payroll tax would not help people who have lost their jobs in this sudden downturn, or who are part of the gig economy and do not get paid by the hour.

Don’t shortchange Social Security for short-term economic stimulus (by Max Richtman) — If the president wants to use Social Security to stimulate the economy, why not boost benefits — instead of cutting payroll contributions?