OPINION

Rise of Medicare Advantage: The creation of a myth

By RICK TIMMONS

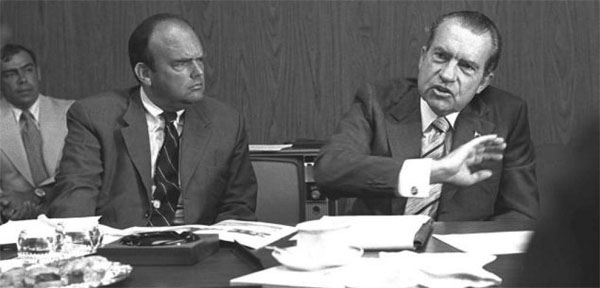

(April 13, 2023) — John Ehrlichman, an advisor to President Richard Nixon, had an interesting discussion with him about changes being considered for Medicare. Ehrlichman described the Health Maintenance Organization (HMO) business model to Nixon: “All the incentives are toward less medical care, because… the less care they give them the more money they make.” Nixon’s reply: “Fine.”

This led to a major change in the trajectory of Medicare.

John Ehrlichman and President Richard Nixon.

Passage of legislation in 1972, 1973, and 1997 gradually introduced the concept of for-profit health care corporations, such as HMOs, to what was originally a non-profit public program. Part C was added to parts A and B of Medicare, and was called Medicare+Choice. When it was renamed Medicare Advantage (MA) in 2003, the systematic privatization of Medicare began.

At first glance, MA might seem like a good deal. The monthly premium is low or non-existent for most plans. Co-pays for most services can be less than Traditional Medicare (TM), unless the beneficiary purchased a Medigap policy. MA plans tout more services, such as vision, hearing, dental, and gym memberships (depending on the plan). Most MA plans include Part D, prescriptions. MA has a cap on out-of-pocket expenses (up to $8,300 for 2023). And celebrities tell us it is wonderful. What’s not to like?

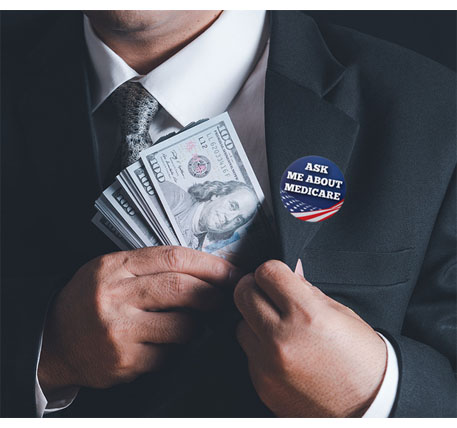

Let’s start with how MA companies make a profit. In TM, doctors and other providers are paid for the services they render (Fee for Service) by Medicare. In MA, Medicare pays private insurance companies through “capitation,” at a rate based on the number of patients in their system and the severity of their medical needs (identified by codes). Additionally, companies are rewarded with bonuses based on a complex system of benchmarks, bids, and quality incentives. The capitation system incentivizes insurance companies to provide less care in order to make more profit. How do they do that?

Limit access to care. MA plans control costs through a network of physicians, hospitals, and other providers with whom they contract for services at a set price. Beneficiaries are restricted to that network, limiting the choice of providers. The extra services offered by some MA plans (vision, hearing, dental) are minimal, and restricted to specific contracted providers, who are often difficult to access. By limiting choices and access, the insurance companies make more profit.

Deny and delay care. Unlike TM, MA beneficiaries are required to receive pre-authorization from the MA plan for diagnostic procedures, referrals to specialists, and for certain drugs. In a survey of physicians by the American Medical Association in 2021, 93% reported delays in the care of their patients due to pre-authorization. Ninety-one percent said it had a negative impact on outcome, and 34% report that the requirement for pre-authorization has resulted in serious consequences for their patients. In the AMA survey, 82% of the physicians reported that patient frustration with the delays caused by pre-authorization can lead to patients abandoning their treatment, which reduces costs to the insurance companies.

In 2018, the Department of Health & Human Services, Office of Inspector General (OIG) investigated whether MA plans would boost revenue by denying access to coverage. Indeed, the OIG found that 13% of denied prior authorization requests and 18% of payment requests that were rejected would have been approved under fee-for-service Medicare. Millions of beneficiaries were illegally denied necessary care.

Game the system. The diagnostic code submitted to Medicare describes the severity of a health issue. By intentionally changing the code to one that indicates greater severity (“upcoding”), MA insurance companies can raise the amount that Medicare will reimburse them. MedPac (a nonpartisan agency that advises Congress about Medicare issues) reported that in 2020, total Medicare payments to MA plans averaged 4% more than to TM, even though MA plans spend 10 to 25% less per beneficiary. The Centers for Medicare & Medicaid Services (CMS) released a summary of audits of payments to just a sample of MA insurance companies, revealing $12 million in overpayments, many due to upcoding, averaging $1,000 per beneficiary. The total cost to taxpayers is much higher, since this is a limited sample. CMS has estimated net overpayments to Medicare Advantage plans at $11.4 billion for 2022. If no changes are made to the system and this trend continues, the Medicare Trust Fund could be depleted by 2028.

Myth: Medicare Advantage offers lower cost and higher quality health care than Traditional Medicare.

Fact: Medicare Advantage is a duplicitous scheme to increase the profits of insurance companies through denial and delay of health care and submission of fraudulent data to Medicare.

Myth: Medicare Advantage will save Medicare money.

Fact: Medicare Advantage costs Medicare more than TM, through excessive administration costs, profits, and fraud. It will hasten the depletion of the Trust Fund.

Rick Timmins is Co-Outreach Vice President for the Puget Sound Advocates for Retirement Action (PSARA) and leads PSARA’s Whidbey Island Committee. He is a retired veterinarian and taught veterinary medicine at higher education institutions. This column originally appeared in PSARA’s Retiree Advocate newsletter and is posted here with the author’s permission.

Rick Timmins is Co-Outreach Vice President for the Puget Sound Advocates for Retirement Action (PSARA) and leads PSARA’s Whidbey Island Committee. He is a retired veterinarian and taught veterinary medicine at higher education institutions. This column originally appeared in PSARA’s Retiree Advocate newsletter and is posted here with the author’s permission.

ALSO SEE:

The Stand (Feb. 23) — PSARA aims to stop Medicare privatization (by Jeff Johnson)

The Stand (April 5) — Traditional Medicare: The promise is in peril (by Lisa Dekker)