OPINION

WA workers’ comp: High benefits, low cost

Business lobbyists complain about injured workers’ benefits being too high, but employers pay less in Washington than most other states

By DAVID GROVES

OLYMPIA (Oct. 12, 2023) — Washington state’s workers’ compensation system is a critical safety net for working families. Its statutory goal is “to provide sure and certain relief for workers, injured in their work, and their families and dependents.” Its benefits help thousands of Washington families avoid economic catastrophe when someone is injured or sickened at work.

Washington’s system, administered by the state Department of Labor and Industries (L&I), delivers the best benefits for injured workers in the nation, and does so at a cost to employers that’s lower than in most other states. That’s a success story for Washington’s workers and businesses alike, right?

Not if you are a corporate lobbyist for the Association of Washington Business.

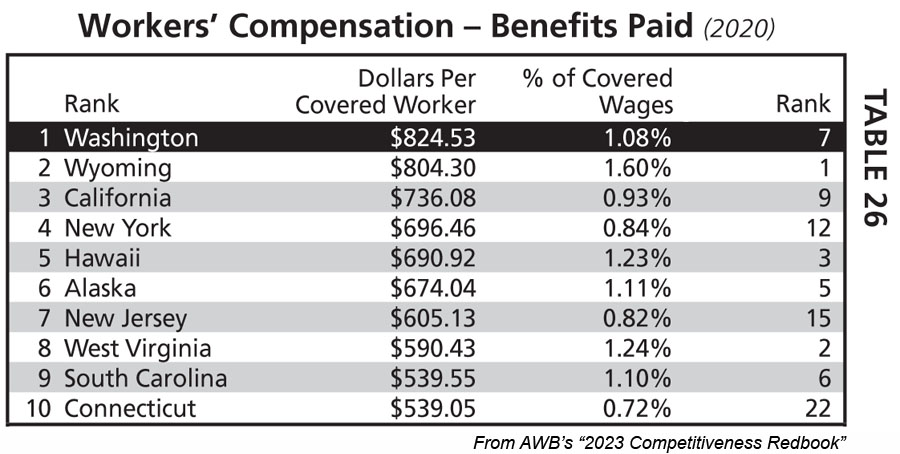

“Washington continues to be a high-cost state for employers in a variety of categories… (with) the highest workers’ compensation benefits paid (in the nation),” reads the AWB’s 2023 Competitiveness Redbook, a handbook that AWB distributes each year to state legislators in support of the group’s lobbying efforts.

But if AWB is concerned about Washington being a “high-cost state for employers,” why don’t they compare the state’s costs for employers with other states, as opposed to complaining about injured workers’ benefits being too high?

The answer is simple. Employers in Washington actually pay less in workers’ compensation premiums than those in most other states. That’s according to the Oregon Department of Consumer and Business Services (DCBS), which conducts a widely cited state-by-state comparison every two years. The latest DCBS study, published in October 2022, found the Washington state ranks 24th highest in workers’ compensation premium rates.

The answer is simple. Employers in Washington actually pay less in workers’ compensation premiums than those in most other states. That’s according to the Oregon Department of Consumer and Business Services (DCBS), which conducts a widely cited state-by-state comparison every two years. The latest DCBS study, published in October 2022, found the Washington state ranks 24th highest in workers’ compensation premium rates.

But the news is actually better than that for employers. Washington is the only state in the nation where workers pay a portion of workers’ compensation premiums — roughly a quarter of the total cost. The Oregon DCBS study does not account for that contribution from workers. If it did, Washington state would rank 38th in the nation in employer costs for workers’ compensation.

Because workers pay into the system, our state has always sought to maintain a strong safety net for families who have lost their source income due to work-related illness or injury. That’s why the system’s benefits are generally higher here than in other states.

But when workers’ compensation rates increase, however modestly — as L&I recently proposed for 2024 — it’s an opportunity for corporate lobbyists to complain to state lawmakers, who they hope won’t distinguish between costs and benefits.

“We’re disappointed that Washington once again missed an opportunity to lower costs for employers and to help them navigate this challenging economy,” said AWB President Kris Johnson in response to L&I’s proposed average 4.9 percent rate increase for 2024.

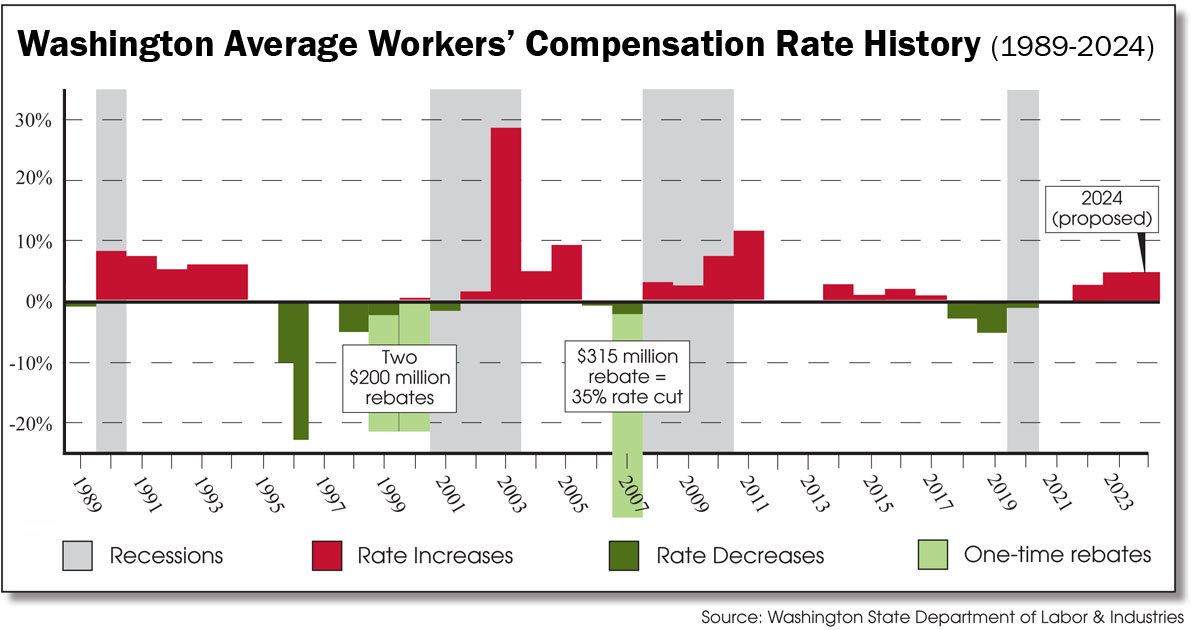

AWB’s call to lower workers’ compensation costs for employers amid a challenging economy ignores our state’s previous experience with such cuts — that they result in dramatic spikes in subsequent premiums.

Immediately prior to the 2001-03 and 2008-10 recessions, Washington’s businesses were given significant rate cuts and one-time rebates. Businesses got $200 million in workers’ comp rebates in both 1999 and 2000, and ended up having to pay it all back, and then some, in the form of rate increases in the years that followed to keep the system solvent. That included a massive 28.8 percent rate increase in 2003. Just as the system stabilized, another $315 million rebate in 2007 led to four straight years of rate increases in the middle of the Great Recession. (See the chart above and the source data here.)

That’s why the state’s Workers’ Compensation Advisory Committee has worked so hard to stabilize rates since then. By lowering projections for trust fund investment earnings and making a series of small rate increases in 2014-17, the system has enjoyed an unprecedented period of rate stability while establishing reserves sufficient to withstand the next recession.

“L&I has spent 12 years engaging labor and employer stakeholders to develop strategies to make rates stable and predictable while ensuring workers’ compensation accounts carry a healthy reserve,” said Joe Kendo, Chief of Staff of the Washington State Labor Council, AFL-CIO. “As a result, the department has been able to propose rates that largely absorbed increased claims costs driven by wage growth. This has meant lower premiums paid by workers and employers, and more stability within the system for workers and their employers during the pandemic.”

Let’s hope Washington state policymakers and legislators ignore the corporate spin and instead focus on how to preserve and strengthen our state’s high-benefit, low-cost safety net for injured workers. When it comes to workers’ compensation, the bottom line should not be businesses’ bottom lines.

David Groves is the Editor of The Stand.