STATE GOVERNMENT

State Senate advances Millionaires Tax

Labor leaders hail passage of revenue bill that will provide sustainable funding for health care, education, and child care

OLYMPIA, WA (February 17, 2026) — Washington is one step closer to righting its upside down tax code. On Monday, SB 6346 was voted off the Senate floor; the legislation will now move to the State House for consideration. The bill passed by a vote of 27 to 22, with Democrat Sens. Adrian Cortes, Drew Hansen, and Debra Krishnadasan voting against the bill. No Republicans voted in support.

The details of the proposed tax are broadly similar to the policy introduced earlier this month; a 9.9% tax on incomes in excess of $1 million a year. It would be paid by about .25% of Washingtonians, and expands the Working Families Tax Credit and cuts sales tax on personal hygiene products. It includes a small business B&O tax exemption for businesses grossing less than $300,000 (an amendment included in the Senate Ways & Means Committee increased that amount from $250,000). Roughly 65% of all businesses in Washington will benefit from this exemption. An amendment from Sen. Marko Liias rolling back a services sales tax increase was also included.

“Washington is one step closer to sustainable revenue and a more fair tax code, where the wealthiest among us pay their fair share to fund the programs and services that help make life more affordable for working people,” said Washington State Labor Council President April Sims. “Many thanks to the Senators who stood with working families and voted to advance the Millionaires Tax.”

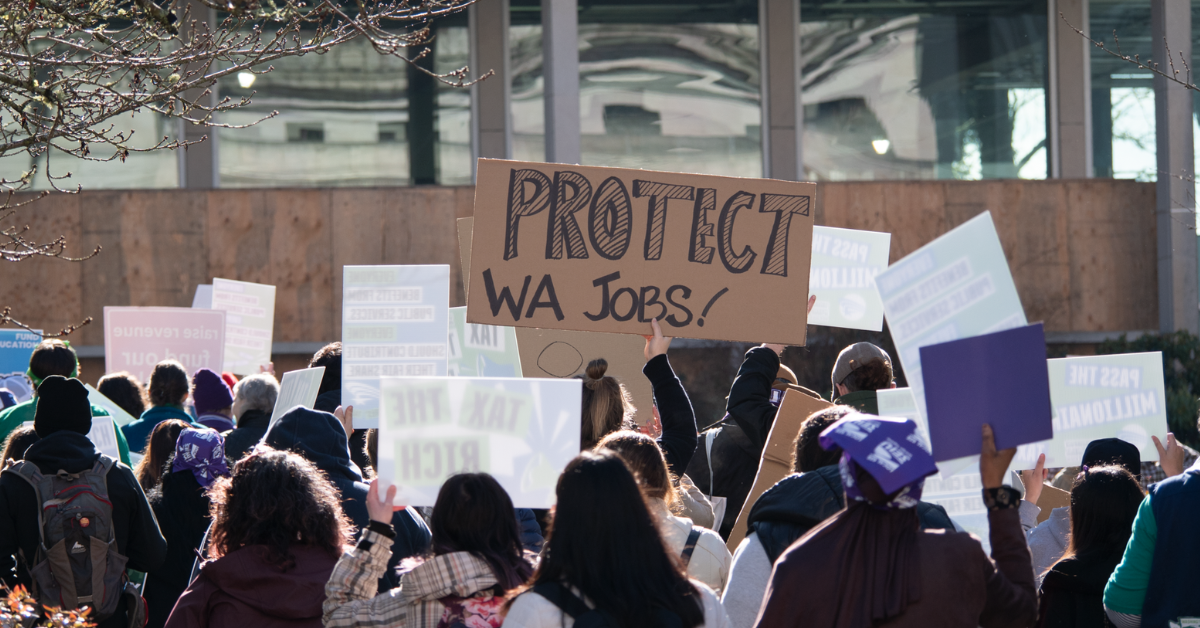

Union members march around the State Capitol on February 10 urging lawmakers to support the Millionaires Tax.

Hundreds of union members rallied last week at the State Capitol to urge lawmakers to support the proposed tax. Labor leaders celebrated the bill’s passage Monday afternoon and urged the House to quickly take up the legislation for consideration.

“For too long the regressive tax system in Washington has not provided the revenue necessary to adequately fund our pre-K through higher ed. public education systems. As a result, our state is not delivering on its paramount duty,” said Larry Delaney, Washington Education Association President. “The Millionaires Tax will shift the tax burden from working families and small business owners and help to build the world class public education systems that our students and communities deserve.”

Budget writers estimate the tax could bring in as much as $3.7 billion annually to fund education, health care, and child care. Beyond sustainable funding for these essential services, the Millionaires Tax also addresses a systemic problem with Washington’s tax revenue. In a news release announcing the bill’s passage, Democrats in the State Senate highlighted the deep injustice in the state’s tax code: those with incomes in the bottom 20% pay 13.8% of their total income in taxes, while those in the top 1% pay only 4.1%.

For working families, that imbalance has persisted for far too long.

“In this state, the richer you are, the less you pay. The poorer you are, the more you pay,” said Washington Federation of State Employees President Mike Yestramski. “The Millionaires Tax is the line. It says, if you make millions in this state, you will contribute. No loopholes. No freebies. No more excuses.”