STATE GOVERNMENT

Big business targets Rep. Gregory with dishonest political attacks

By DAVID GROVES

The Stand

FEDERAL WAY (July 31, 2015) — Big corporations based in Washington state — from Alaska Air to Liberty Mutual to T-Mobile — are running an aggressive, dishonest campaign to unseat state Rep. Carol Gregory (D-Federal Way) in this fall’s special election, prompting the question: what are they so afraid of?

FEDERAL WAY (July 31, 2015) — Big corporations based in Washington state — from Alaska Air to Liberty Mutual to T-Mobile — are running an aggressive, dishonest campaign to unseat state Rep. Carol Gregory (D-Federal Way) in this fall’s special election, prompting the question: what are they so afraid of?

Gregory was appointed to the state House of Representatives by Gov. Jay Inslee in January to fill the vacant 30th Legislative District seat left following the death of Rep. Roger Freeman in October 2014. She is running in a special election this fall to retain the position.

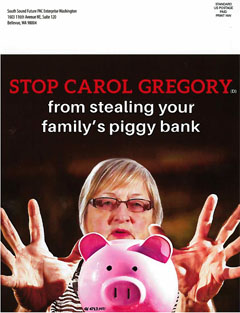

With the primary election days away, voters in her district are getting political hit pieces in the mail from the “South Sound Future PAC” that accuse Gregory of supporting a state income tax. That PAC has also financed TV ads, a website, and other materials with similar claims.

According to Public Disclosure Commission reports, the effort is partly funded by the Washington Restaurant Association and the Washington Association of Realtors, but primarily it is paid for by another PAC called Enterprise Washington (EW). Who funds EW? A who’s who of Washington corporate special interests with most state industries represented:

► Airlines (Alaska Air)

► Construction (AGC of Washington)

► Energy (PSE)

► Food (Food Industry PAC, Kroger)

► Forest products (Georgia-Pacific, Green Diamond)

► Insurance (Liberty Mutual, CNA)

► Media (Cowles-Spokesman Review)

► Telecommunications (T-Mobile)

In fact, all of the $100,000 these corporations have spent so far in the 2015 election cycle via EW has been devoted to unseating Rep. Gregory.

That makes the campaign aggressive, but is it dishonest? Did she really support a state income tax?

The issue didn’t come up in 2015, the only year Gregory has served as State Representative. But back in 2010, it was on the ballot at a time when the state was facing a multi-billion budget deficit and was about to call an emergency special session to further cut education and health care programs. At the time, The Seattle Times wrote:

Gregory was hesitant to take a side on Initiative 1098, a proposed state income tax targeting the wealthiest earners that will be on the November ballot. “I get nervous when we do tax policy by initiative,” she said. But she added, “We will be better off in the short term if it passes.”

Five years later, the companies of EW have edited that Seattle Times quote into: “We will be better off” passing “a proposed state income tax.”

Five years later, the companies of EW have edited that Seattle Times quote into: “We will be better off” passing “a proposed state income tax.”

In fact, Gregory wasn’t just “hesitant.” As the business-funded news blog Washington State Wire pointed out five years ago, she opposed Initiative 1098, which was rejected by voters later that year.

So in 2010, business interests were celebrating Gregory’s opposition to a state income tax proposal. But in 2015, they have creatively edited a single quote to mislead voters into thinking the exact opposite: she wants to “break your piggy bank with a new INCOME TAX.”

That’s dishonest.

(As an aside, I-1098 would have taxed only those individuals earning more than $200,000/year or couples making more than $400,000 — affecting an estimated 1.2 percent of the state’s wealthiest people at the time — but it also would have cut the state share of property taxes by 20 percent. Had Gregory supported I-1098 — which she clearly did not — and had it passed, far more of her constituents would have had lower taxes than would have had their piggy banks broken into and robbed.)

So why are corporate special interests dishonestly manipulating a state representative’s quote in an aggressive campaign to turn voters against her? Look no further than Rep. Gregory’s voting record on working families’ issues:

Paid safe and sick leave — Gregory co-sponsored and voted for a bill to allow all workers in Washington to earn paid safe and sick leave (HB 1356), a bill that was aggressively opposed by all of the above-listed corporate interests. Polls show that overwhelming majorities of Americans — including those who self-identify as Republicans — support requiring employers to offer some level of paid sick leave.

Raising the minimum wage — Gregory co-sponsored and voted for legislation to raise the state minimum wage to $12 over the next four years (HB 1355), a bill that was aggressively opposed by the restaurant, food, and other industries. Again, polls show strong support for raising the minimum wage.

Equal pay for equal work — Gregory co-sponsored and voted for the Equal Pay Opportunity Act (HB 1646) empowering workers to combat wage discrimination based on gender, which was opposed by the above-listed corporate interests.

Promote apprenticeship and responsible bidders — Gregory voted to promote apprenticeship opportunities (HB 1590) and to promote responsible bidders on state contracts by adding restrictions on bidders who violate wage laws (HB 1089), both of which were aggressively opposed by the construction industry.

On all of those issues, Gregory’s position is clearly on the side of public opinion and her constituents in the 30th Legislative District. She has not only supported working families on these issues, she has been a leader and co-sponsored many of them. And that is why corporate special interests want to get rid of her.

But rather than listing the real reasons they oppose retaining Gregory as State Representative, big business is manufacturing a negative issue out of whole cloth because they know that her actual record of advocacy for working families is popular with her constituents.

The more you know…