NEWS ROUNDUP

Minimum wage, food money, corporate 0%-ers…

Monday, October 28, 2013

LOCAL

The logo from 1998’s Initiative 688 campaign. It was approved in every county of the state, passing by a two-to-1 margin.

► In today’s Yakima H-R — Is minimum wage increase a boon or bane for business? — As it has almost every year since a voter-approved initiative created the law in 1998, the state’s minimum hourly wage will increase from $9.19 to $9.32, based on the federal Consumer Price Index, on Jan. 1. That also means an adjustment for employers, who disagree over the law’s impact on businesses.

EDITOR’S NOTE — Of course, the minimum wage wasn’t established to placate business owners. It was established to make sure working people — and taxpayers — aren’t exploited. Full-time workers shouldn’t be forced to live in poverty. Taxpayers must not be forced to subsidize low-wage businesses by having the government provide food, health care and other basic needs to people paid poverty wages.

Which brings us to…

WE ALL PAY FOR LOW WAGES

► McDonald’s can’t say it doesn’t know it pays its workers so little that many of them qualify for public assistance (52% of fast-food workers do) to eat, go to the doctor or heat their homes. In fact, the burger giant appears to encourage its employees to seek out government help to meet the ends that their paychecks won’t.

ELECTION

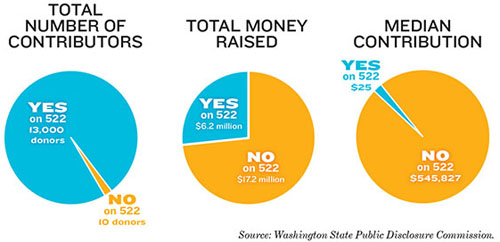

► From AP — Yes on I-522 campaign sees influx of cash from food industry group — With a week to go before the November election, the Grocery Manufacturers Association is turning up the heat in the fight over labeling genetically engineered foods, spending heavily in recent days to defeat Initiative 522. The Washington, D.C.-based food industry group contributed about $3.7 million last week to the No on 522 campaign. The lobbying group has now spent more than $11 million to defeat I-522.

ALSO at The Stand — Here’s why the Washington State Labor Council has endorsed I-522 (by Nicole Grant) — The workers who are most vulnerable to the toxic exposure associated with genetically modified organisms are farm workers. For this reason, the United Farm Workers have taken a strong stance in favor of I-522. They are joined by the Washington State Nurses Association, International Brotherhood of Electrical Workers Local 46, and dozens of other unions, environmental groups and sustainable businesses.

ALSO at The Stand — Here’s why the Washington State Labor Council has endorsed I-522 (by Nicole Grant) — The workers who are most vulnerable to the toxic exposure associated with genetically modified organisms are farm workers. For this reason, the United Farm Workers have taken a strong stance in favor of I-522. They are joined by the Washington State Nurses Association, International Brotherhood of Electrical Workers Local 46, and dozens of other unions, environmental groups and sustainable businesses.

► In the Spokesman-Review — In 7th District State Senate race, mud and money fly

THE STAND’S SUMMARY™ — Appointed Republican incumbent John Smith, a business consultant with a spotty record of paying his taxes, accuses his Republican challenger Brian Dansel, a Ferry County Commissioner, of being a tool for the unions because he has received labor endorsements. It should come as no surprise that unions would support an alternative. In his one year in the Legislature, Smith co-sponsored legislation to create a sub-minimum wage and earned a 0% voting record on working families issues. “Tool” is in the eye of the beholder.

► In today’s Seattle Times — Voters to weigh in on 5 tax increases the Legislature approved — The ballot includes advisory votes on five tax increases approved by state lawmakers earlier this year. The advisory votes are the result of a Tim Eyman-sponsored initiative.

► In today’s Seattle Times — Voters to weigh in on 5 tax increases the Legislature approved — The ballot includes advisory votes on five tax increases approved by state lawmakers earlier this year. The advisory votes are the result of a Tim Eyman-sponsored initiative.

ALSO at BudgetAndPolicy.org — Public advisory votes on November ballot are tailored to deceive — Given that they have no impact on state law or previously enacted tax changes, it is clear that the only reason advisory votes were included in Eyman’s broader initiatives was to distort the public dialogue on taxes and the investments they support, and to dissuade policymakers from making any reasonable changes to our flawed tax system.

STATE GOVERNMENT

► From AP — State website for health insurance still ailing — Washington’s new health insurance marketplace is fully functional, but three weeks after the Web-based application’s shaky launch, technicians are still fixing problems almost daily.

After trying to sign up during the first few days of October and failing, William Towey logged back in a few days later and had health insurance in less than 30 minutes. On Jan. 1, the 48-year-old, self-employed handyman from Tacoma will be covered by health insurance for the first time in more than a decade. He said he shopped for health insurance about a year ago but gave up when he found it would have cost between $400 and $500 a month. The plan he signed up for this month will cost about half that amount.

After trying to sign up during the first few days of October and failing, William Towey logged back in a few days later and had health insurance in less than 30 minutes. On Jan. 1, the 48-year-old, self-employed handyman from Tacoma will be covered by health insurance for the first time in more than a decade. He said he shopped for health insurance about a year ago but gave up when he found it would have cost between $400 and $500 a month. The plan he signed up for this month will cost about half that amount.

► In the Spokesman-Review — Washington may lose federal jobs grant — The federal government has awarded $2.7 million to Washington state to improve job training and regain manufacturing jobs that have gone overseas. But whether Washington receives the economic development money is uncertain, depending on if state money can be added to the federal grant. Washington’s grant application requires state agency Innovate Washington to provide $731,000 in matching dollars, but the Legislature hasn’t approved the funding.

► In the News Tribune — Liquor Board wants to hire more officers — State regulators overseeing marijuana legalization are asking for money to keep or hire 46 more employees next year.

LOCAL

► In today’s Columbian — Vancouver oil-terminal plan begins review — The proposal by Tesoro Corp. and Savage Companies to build the largest oil-handling operation in the Pacific Northwest at the Port of Vancouver begins its yearlong regulatory journey today, with a public meeting from 6 to 9 p.m. at Clark College’s Gaiser Student Center, 1933 Fort Vancouver Way.

NATIONAL

► At Think Progress — Over 10 percent of largest American companies pay 0% tax rates — Among companies listed on the S&P 500, almost one in nine paid an effective tax rate of zero percent — or even lower — over the past year, according to an analysis by USA Today. There are 57 separate companies listed on the index that paid a zero percent rate from the past year. Getting to a zero percent tax rate despite turning a profit requires creative accounting, but not lawbreaking. The corporate tax code allows companies to avoid tax liability even in years when they turn a profit. Some of the profitable companies on the newspaper’s list, such as General Motors, achieved a zero percent rate by banking tax credits from previous years when business was bad. But the more common gambit involves moving revenues from parent companies to offshore subsidiaries based in tax haven countries in the Caribbean, Europe, and elsewhere.

► At Think Progress — Over 10 percent of largest American companies pay 0% tax rates — Among companies listed on the S&P 500, almost one in nine paid an effective tax rate of zero percent — or even lower — over the past year, according to an analysis by USA Today. There are 57 separate companies listed on the index that paid a zero percent rate from the past year. Getting to a zero percent tax rate despite turning a profit requires creative accounting, but not lawbreaking. The corporate tax code allows companies to avoid tax liability even in years when they turn a profit. Some of the profitable companies on the newspaper’s list, such as General Motors, achieved a zero percent rate by banking tax credits from previous years when business was bad. But the more common gambit involves moving revenues from parent companies to offshore subsidiaries based in tax haven countries in the Caribbean, Europe, and elsewhere.

► In today’s NY Times — “Not one more” (editorial) — The shutdown was a fake emergency. Immigration is a real one, harming lives every day in every state. President Obama has sometimes been resentful when immigrant advocates remind him of his failures. Now, at least, he has invited their pressure.

The Stand posts links to Washington state and national news of interest every weekday morning by 10 a.m.