STATE GOVERNMENT

Voters back tying aerospace tax breaks to jobs, wages

RENTON (Feb. 17, 2015) — New polling shows that more than two-thirds of likely Washington voters support tying tax breaks for aerospace companies to requirements for maintaining jobs and providing living wages.

RENTON (Feb. 17, 2015) — New polling shows that more than two-thirds of likely Washington voters support tying tax breaks for aerospace companies to requirements for maintaining jobs and providing living wages.

The findings show strong support for two pieces of legislation now being considered in Olympia that would add accountability to the $8.7 billion aerospace tax preference bill. Approved in November 2013 during a special session, the legislation extended current cuts in Business & Occupation tax rates for aerospace companies, including Boeing, along with other tax credits, until 2040.

The two legislative bills, one addressing jobs and the other wages, will bring aerospace tax incentives in line with legislation in other states and Washington’s original intent to maintain and grow the state’s aerospace industry with good, family wage jobs.

TAKE A STAND! Send a message to your state legislators urging them to support this important legislation!

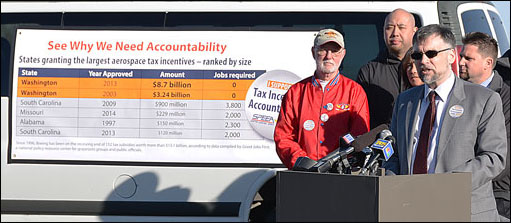

SPEEA Executive Director Ray Goforth opens the Feb. 16 press conference announcing proposed legislation to tie tax incentives to job requirements and wage standards.

The effort to add accountability to the tax incentives was officially launched Monday at a press conference overlooking the Boeing plant in Renton by Rep. June Robinson (D-Everett), members of the Machinists Union District Lodge 751 and the Society of Professional Engineering Employees in Aerospace (SPEEA), IFPTE Local 2001.

“Our legislation will ensure aerospace tax incentives are used to benefit the people who grant them — taxpayers in Washington,” said Robinson. “Other states require Boeing to bring jobs to receive tax breaks and it’s only fair that the citizens of Washington demand the same treatment.”

The survey was conducted Feb. 2-8 by EMC Research, which polled 771 registered voters statewide. It had a 3.5 percent margin of error. Among the key findings were that 73 percent of the voting public support tying tax breaks to jobs. As proposed, the amount of the tax break would be reduced for companies if its in-state employment drops below certain benchmarks.

“Within days of getting tax breaks from Washington, Boeing started moving work out,” said Ray Goforth, executive director of SPEEA. “Boeing cuts employment in Washington and moves the work to states that required the company to add workers in exchange for tax breaks. Boeing doesn’t add a single employee, but is able to get tax breaks from two states.”

The survey also showed that 68 percent of voters support establishing a wage standard for companies receiving the tax breaks. Introduced by Rep. Mia Gregerson (D-SeaTac), HB 1786 gives aerospace companies an option: Either pay experienced workers wages equal to the typical Washington worker’s paycheck by year three of employment, or for-go the tax break.

“The survey results were very clear — voters want our legislators to act to ensure that we’re actually getting the jobs that we’re already paying for,” said IAM 751 President Jon Holden. “It’s an issue of fairness. If we as Washington citizens are going to give hundreds of millions of dollars each year to an industry that generates billions of dollars in profits, then we should get good family-wage jobs in return.”