STATE GOVERNMENT

As L&I rates edge up, business aims to cut workers’ comp

Corporate lobbying groups decry 0.7% rate hike, set sights on workers’ comp cuts

By DAVID GROVES

The Stand

TUMWATER (Dec. 8, 2016) — The rates paid for workers’ compensation coverage in Washington will rise by an average of 0.7 percent in 2017, the Washington State Department of Labor & Industries (L&I) announced last week. Employers and workers in Washington pay into the workers’ comp system so that medical costs and time missed from work are covered in the event of a work-related injury or illness.

TUMWATER (Dec. 8, 2016) — The rates paid for workers’ compensation coverage in Washington will rise by an average of 0.7 percent in 2017, the Washington State Department of Labor & Industries (L&I) announced last week. Employers and workers in Washington pay into the workers’ comp system so that medical costs and time missed from work are covered in the event of a work-related injury or illness.

Washington’s workers’ compensation system is unique not only because it is state-run, but also because its rates are based on hours worked, not on wages paid. That means the cost of coverage doesn’t automatically rise in Washington as wages increase, like it does in all other states. L&I’s 0.7 percent average rate increase for 2017, because it’s significantly less than the wage inflation rate, could be considered a rate decrease compared to other states’ payroll-based systems.

But business lobbying groups are not happy.

The Association of Washington Business, the state’s Chamber of Commerce, calls the 0.7 percent increase “yet another blow to employers.” The AWB told its member businesses that L&I “has elected to impose a tax increase on Washington employers that it does not need to impose.” They argue that premiums could have been reduced instead and the system would still break even.

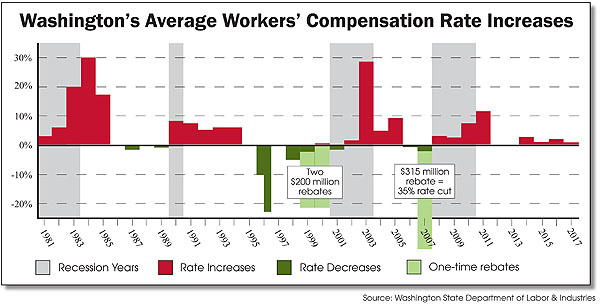

That criticism deliberately ignores L&I’s ongoing objective — under a plan endorsed by state, labor and business interests, including the AWB itself — to gradually rebuild the system’s reserve-fund cushion to avoid rate spikes that occur in economic downturns. (See the chart below.) That 10-year plan initiated in 2012 was endorsed by the Workers’ Compensation Advisory Committee, which advises L&I on the system. In fact, the AWB lobbyist who fired off a next-day news release decrying the 0.7% rate hike is a member of the WCAC.

The truth is, thanks to L&I reforms and efficiencies supported by both business and labor, actual rate increases since 2012 have been significantly lower than the 5.5 percent rate increases originally envisioned in that 10-year plan to restore reserves to safer recession-proof levels. Those reforms, which include expanding the Centers of Occupational Health & Education, creating a statewide medical provider network and a new “Stay at Work” program, are successfully helping to prevent work injuries, returning injured workers to jobs quicker, and saving the system hundreds of millions of dollars, according to L&I.

The truth is, thanks to L&I reforms and efficiencies supported by both business and labor, actual rate increases since 2012 have been significantly lower than the 5.5 percent rate increases originally envisioned in that 10-year plan to restore reserves to safer recession-proof levels. Those reforms, which include expanding the Centers of Occupational Health & Education, creating a statewide medical provider network and a new “Stay at Work” program, are successfully helping to prevent work injuries, returning injured workers to jobs quicker, and saving the system hundreds of millions of dollars, according to L&I.

Those cost-saving reforms — plus an improving economy that has bolstered investment returns — have enabled L&I to avoid those 5.5 percent annual increases. Instead, the average annual workers’ compensation rate increase over the past six years has been just over 1 percent.

So why are business groups complaining so much?

The short answer: because it’s what they do. Groups like the AWB are paid by their client businesses to lobby lawmakers for lower business taxes, fewer regulations, and cheaper workers’ compensation coverage. So any rate increase, however small, will draw complaints because it could always cost less.

Their complaints about workers’ compensation costs are likely to grow louder as the legislative session approaches. Every year in Olympia, the AWB and allied business groups support legislation to cut injured workers’ benefits — and thus their clients’ costs. And every year, that pits business versus labor and other advocates for maintaining a strong safety net for injured workers.

So complaining about an 0.7 percent increase — one that is actually less than expected and lower than the wage inflation rate that businesses in other states must automatically pay — sets the stage for the 2017 battle over workers’ compensation benefits.

What benefit cuts will they propose in 2017?

The same 2011 legislation that enabled the above-mentioned cost-saving reforms included one very divisive proposal: structured settlements or lump-sum buyouts of injured workers’ claims, alternatively known as “compromise and release” (or “starve and settle,” depending on who you’re talking to).

When 10,000 gathered at the State Capitol at this April 8, 2011 rally, several speakers urged opposition to “starve and settle” — also known as “compromise and release” buyouts.

These buyouts allow employers in Washington to negotiate lump-sum payments to settle claims with certain injured workers who agree to the terms. This has been aggressively opposed by organized labor because injured workers will agree to less than what they would otherwise receive due to short-term financial hardships even though it’s not in their long-term best interests. In fact, the only way these buyouts save the system money is if injured workers get fewer benefits.

Lacking the votes to approve lump-sum buyouts in 2011, supporters agreed to add additional safeguards to ensure settlements were in the workers’ “best interests” and to restrict them to older workers near retirement who have a better chance of making informed decisions about their family’s livelihood. And thus, the buyouts were legalized for older workers.

Ever since then, business interests and their legislative advocates have tried to chip away at those restrictions and safeguards. They have proposed to remove the language about workers’ “best interests” and they have sought to lower or eliminate the age restrictions on which injured workers can be bought out. To date, those efforts have failed.

Look for business interests to try again to expand lump-sum buyouts in 2017. Other proposed changes include changing how benefits are calculated for injured construction workers so they get less, putting new time limits on filing occupational disease claims, and other “reforms” that reduce benefit eligibility or amounts.

How will they try to justify those benefit cuts?

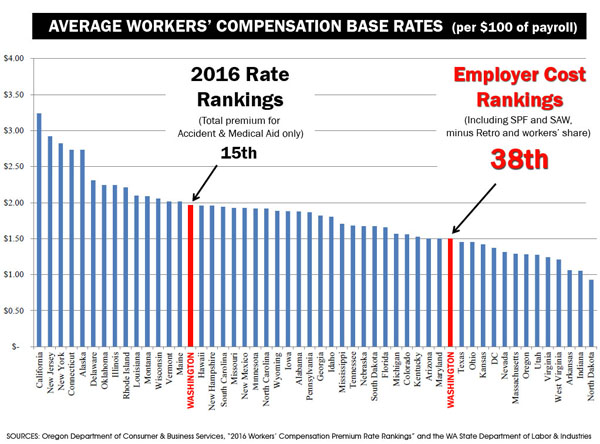

Business groups and conservative legislators claim that Washington has the highest workers’ compensation rates in the nation. It’s demonstrably untrue, but they continue to say it anyway. In fact, they just did in last week’s news release, writing that Washington is “known for consistently having the highest workers’ compensation rates in the nation.”

It’s a deliberate obfuscation.

By some measures, Washington state has among the highest benefit levels provided to injured workers. But in terms of the costs paid by employers and workers, Washington is in the middle of the pack, ranked 15th highest in the latest state-by-state comparison by the Oregon Department of Consumer and Business Services.

But Washington employers have it even better than that. The Oregon study doesn’t account for the fact that Washington is the only state where workers pay a portion of the premiums. So in terms of employers’ costs for workers’ compensation coverage, Washington actually ranks 38th, with only 12 states offering lower rates. (See L&I’s explanation accounting for Washington’s unique cost structures and deducting the workers’ share of premiums.)

Yes, Washington has comparatively high benefits, but it also has comparatively low employer costs. Organized labor contends that this exactly the type of system Washington needs to maintain, one that takes good care of workers who’ve temporarily or permanently lost their family’s livelihoods due to work-related injuries or disease, but does so at a competitive cost to the state’s employers.

But business lobbying groups will continue to try to confuse the two — benefits and costs — in their quest to cut both.