STATE GOVERNMENT

Washington state’s tax system: Unfair and outdated (video)

(Feb. 24, 2015) — USA Today recently reported that Washington state has “by far the most regressive tax system nationwide.” Meanwhile, chronic underfunding of basic education, mental health, higher education, and other basic state functions has state legislators facing “contempt of court” charges.

(Feb. 24, 2015) — USA Today recently reported that Washington state has “by far the most regressive tax system nationwide.” Meanwhile, chronic underfunding of basic education, mental health, higher education, and other basic state functions has state legislators facing “contempt of court” charges.

How did this happen?

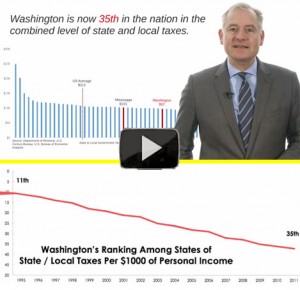

In this must-see video, Rep. Reuven Carlyle (D-Seattle), Chairman of the House Finance Committee, outlines Washington’s broken and regressive tax structure; explains how the state’s high reliance on a sales tax has placed an unfair tax burden on its poorest residents, average earners and the state’s small businesses (while letting major industries and international corporations off the hook); and demonstrates how in the past 20 years Washington dropped from 11th to 35th in terms of the combined level of state and local taxes per $1,000 of earnings.

“Washington is on the march to becoming a low tax, low service, low quality-of-life state,” Carlyle says. “It’s time to acknowledge the profound implications of our revenue structure.”

Please watch it and share this with your friends, family and co-workers in Washington state.