NATIONAL

10 years of ‘expensive, ineffective’ tax cuts

Tuesday, June 7 was the 10-year anniversary of President George W. Bush’s tax cuts that went mostly to very rich individuals and big corporations.

As AFL-CIO Now pointed out,

According to the rosy economic scenario Bush and the Republicans painted, the nation today should be figuring out to what to do with a $5.6 trillion budget surplus and just how to fill the tens of millions of new jobs that were supposed to generate new wealth for all of us.

Instead of a surplus, we have a record budget deficit. As for jobs, even in the pre-recession period from 2002 to 2007, job creation was dismal, barely keeping pace with population growth, and was the worst employment performance in the post-World War II era, according to a new Economic Policy Institute report, “Tenth Anniversary of the Bush Tax Cuts: A Decade Later, the Bush Tax Cuts Remain Expensive, Ineffective, and Unfair.”

The report includes statistical evidence that the Bush tax cuts disproportionately benefited the wealthy, they accomplished very little for low-income families, they never “trickled down” to raise wages and create jobs, and failed to create long-term economic growth, as promised. In sum, although the Bush tax cuts were touted as an economic stimulus, they were phased in after the economy recovered from the 2001 recession and, in fact, created a major drag on the economy by adding greatly to the nation’s debt.

The report includes statistical evidence that the Bush tax cuts disproportionately benefited the wealthy, they accomplished very little for low-income families, they never “trickled down” to raise wages and create jobs, and failed to create long-term economic growth, as promised. In sum, although the Bush tax cuts were touted as an economic stimulus, they were phased in after the economy recovered from the 2001 recession and, in fact, created a major drag on the economy by adding greatly to the nation’s debt.

Republicans, who have now taken up the mantle of reducing the nation’s debt, refuse to acknowledge the significant role the Bush tax cuts have played in increasing that debt. In fact, most GOP presidential contenders and other party leaders are calling to make those tax cuts permanent, claiming that “they paid for themselves” by inducing economic growth.

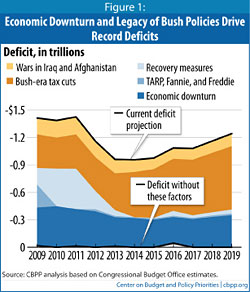

As the new EPI report points out (and the chart above demonstrates), that is simply not true. Federal tax revenue fell from the Clinton era’s 20.6% of the gross domestic product in 2000 to the Bush era’s 18.5% of the GDP in 2007, adding $2.6 trillion to the public debt between 2001 and 2010, which is nearly 50% of the debt during that period.

But given its unbending “anti-tax orthodoxy” (as described in Sunday’s New York Times), the new Republican Party has used the nation’s debt as its excuse to slash federal government services, underfund job-creating infrastructure improvements, and dismantle America’s social compact by attempting to end Medicare and privatize Social Security.

President Barack Obama recently said that he will “refuse to renew” the Bush tax cuts for the rich. He made a similar pledge in 2010 to block the tax cut’s extensions for the wealthy, defined as individuals who make more than $200,000 and couples who make more than $250,000. But as the deadline for their expiration approached, Republicans threatened to allow ALL of the tax cuts expire, including those to low- and middle-income families, unless the rich got their extension, too. In the end, the president blinked. The Bush tax cuts were extended for two years and are now set to expire sat the end of 2012, setting up the issue to be one of the defining debates of Obama’s 2012 re-election campaign.

But given their success in 2010, expect Republicans to hold the entire package of tax cuts hostage again in 2012.