STATE GOVERNMENT

Phantom workers’ comp tax hikes threaten state government shutdown

By DAVID GROVES

The Stand

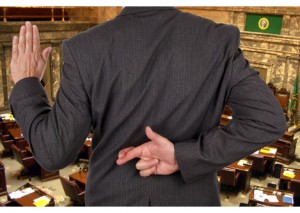

OLYMPIA (June 10, 2013) — Over the weekend, Republicans in the State Senate made clear that they are willing to force a second special session and they are not willing to compromise on the state budget, unless the House approves “reforms” that include expanding the lump-sum buyouts in workers’ compensation. They also stepped up their rhetoric on that front, claiming that unless they get their way, there will be a “guaranteed” tax increases on businesses.

OLYMPIA (June 10, 2013) — Over the weekend, Republicans in the State Senate made clear that they are willing to force a second special session and they are not willing to compromise on the state budget, unless the House approves “reforms” that include expanding the lump-sum buyouts in workers’ compensation. They also stepped up their rhetoric on that front, claiming that unless they get their way, there will be a “guaranteed” tax increases on businesses.

Given the facts about the workers’ compensation system’s quickly improving financial condition and the effectiveness of 2011 legislative changes — at least those supported by both business and labor — in reining in costs, the guarantee of tax increases is difficult to defend.

A week ago, Gov. Jay Inslee called on lawmakers to work harder to compromise and finish their work before the first special session ends tomorrow (Tuesday, June 11). The House immediately responded by introducing and passing a new biennial operating budget proposal, on a 53-35 vote, that compromised with the Senate by more than splitting the $1.2 billion difference between the two bodies’ previously approved budgets. But rather than declare victory, Senate leaders rejected the compromise and passed an all-cuts budget Saturday that is nearly identical to its original one. It was a strictly partisan 25-23 vote with all 23 Republicans and Sens. Rodney Tom and Tim Sheldon, who have left the Democratic caucus to accept leadership roles in the Republican caucus, voting “yes” and all 23 Democrats voting “no.”

Meanwhile, Senate Republicans also demanded five contentious policy bills, including one that cuts injured workers’ benefits, before they would agree to resolve budget differences. Sen. Janéa Holmquist Newbry (R-Moses Lake) claimed that, without further “reforms,” the state’s workers’ comp reserve funds won’t have enough money to avoid hundreds of millions of dollars in premium-rate hikes on businesses as the system rebuilds its reserves after the Great Recession.

“If we see inaction by the Legislature this year, it is a guaranteed tax on employers,” Holmquist Newbry told The Olympian. It was clearly an attempt to create a sense of urgency that would justify the Senate’s stance on holding the budget hostage, a stance now likely to force the second special session.

But by any objective measure, the workers’ compensation system’s financial situation is far from urgent and simply does not support the dire warnings of tax increases, much less a continuing political standoff that threatens a Washington, D.C.-style government shutdown in Washington State.

Here are the facts:

As the economy has recovered, the workers’ comp system is now running a surplus — Washington’s state-run industrial insurance system had a net operations income — a surplus — of $250 million in the second half of 2012, the Department of Labor and Industries (L&I) just reported. The state credits higher investment income and cost savings resulting from the continuing implementation of 2011 legislative changes for the strong financial performance.

Workers’ comp reserve funds have already increased dramatically — Since the Senate first passed its workers’ comp “reform” legislation this session in February, lawmakers have learned that the system’s Contingency Reserve funds increased 64% from $580 million in June 2012 to $953 million at the end of 2012. That strong performance, announced at the April 30 quarterly Workers’ Compensation Advisory Committee (WCAC) meeting received no press coverage, other than right here at The Stand.

Cost savings from 2011 workers’ comp changes have exceeded projections — Senate Republican leaders claim expanding the most controversial of the 2011 changes, the labor-opposed lump-sum buyouts, is needed because fewer injured workers than originally projected have accepted the buyouts that would save the system money. It’s true that fewer workers are taking the buyouts than supporters had hoped. But taken in their entirety, the 2011 Legislature’s changes to the system, those supported by both business and labor, have saved more money than originally projected. When L&I announced last year that rates would not increase in 2013, the agency credited those cost savings, which it projected will save $1.5 billion over four years, and that’s $300 million higher than originally estimated.

There is no reason to believe — and certainly no “guarantee” — that workers’ comp rates will increase in 2014. There was no increase in either 2012 or 2013, when the system was in far worse financial shape than it is today. As the economy has recovered, the reserves are quickly rebuilding without additional cost-cutting measures.

“These latest numbers are good news for our workers’ compensation system and they strengthen the case for allowing the 2011 changes to be fully implemented before rushing through more legislation that put injured workers and their families at risk,” said WSLC President Jeff Johnson. “Although we’d like to see those reserve funds even higher, the latest numbers have decreased the pressure to raise rates for employers and workers.”

When Senate Republicans claim that tax increases of hundreds of millions of dollars will be needed to rebuild reserves, they are referring to old numbers presented a year ago by L&I based on 2011 financial figures, when business and labor stakeholders asked the agency to present possible scenarios for rebuilding reserves. The “worst-case” of those scenarios, one that assumed virtually no economic recovery but aimed to build reserves to a level so high they couldn’t possibly run out, envisioned 19% rate increases for 10 consecutive years in order to raise $3.1 billion. Although L&I publicly assured that this $3.1 billion figure was not the agency’s goal, the scenario sent business lobbyists into a tizzy, predicting the “mother of all rate increases” in 2013 and that the system’s “long term financial problems” would be a major issue in the Inslee-McKenna gubernatorial race that fall.

That panic turned out to be overblown when L&I announced a few months later that, for the second straight year, there would be no average rate increase at all in 2013.

After the April 30 WCAC report, business lobbyists dismissed the significance of the system’s quickly improving financial condition. In order to justify continued pursuit of benefit cuts in the 2013 legislative session, they simply subtracted the hundreds of millions of dollars in newly announced surplus funds and built-up reserves from that year-old $3.1 billion worst-case scenario that was never the agency’s goal in the first place. And now, Republicans in the Senate are publicly “guaranteeing” tax increases on employers to reach that target, if they don’t get their way on more benefit cuts.

The bottom line: There is no guaranteed tax on employers. In fact, in a few months when L&I announces how much more reserves have continued to build in the first half of 2013, employers could even wind up demanding a rate decrease.

None if the above is intended to explain labor’s opposition to Senate Republicans’ workers’ compensation legislation. Advocates for injured workers oppose it because financial desperation — families who’ve lost their income are likely to be facing sudden, extreme hardship — can lead people into agreeing to lump-sum payments that aren’t in their best interests, or the state government’s. Expanding lump-sum buyouts, particularly for younger workers who can’t anticipate their long-term expenses, will simply shift the cost of debilitating work injuries from businesses to the state government.

See this guest column that recently appeared in The (Everett) Herald, Lump-sum not in interest of injured workers, for a good explanation.