STATE GOVERNMENT

Stop digging Washington state budget hole

Senate proposals to add tax breaks, defer revenue are unsustainable

Today’s edition of the Washington State Labor Council’s Legislative Update newsletter:

OLYMPIA (Mar. 11, 2014) — Washington state legislators are in the home stretch of the 2014 session that ends this Thursday. Over the next couple of days, deals will be struck not only on the supplemental budget but also on some late-breaking policy bills that affect it.

As the Democrat-controlled House and the Republican-controlled Senate resolve their budget differences, many are focused on whether another modest step will be taken toward improving education funding in response to the Supreme Court’s McCleary decision. But when the dust settles on Friday, the question will be: how much harder did this Legislature make the job for right-sizing the 2015-17 biennial budget?

In this election year, some lawmakers avoided the subject of how we will come up with the money needed to fix not only our schools, but our roads, bridges and transit systems. To their credit, the House has taken some tough votes. Last year, they passed a desperately needed transportation package funded by a gas-tax increase. And this year, they voted to repeal more tax breaks to raise money needed for classroom supplies and long-overdue cost-of-living pay adjustments for teachers and school employees.

But Rodney Tom and the Senate Republican majority have avoided those tough choices, both on transportation and on schools. In fact, the Senate’s budget proposal and several policy bills not only avoid those choices, they dig a deeper budget hole by creating more special-interest tax breaks and deferring more revenue.

But Rodney Tom and the Senate Republican majority have avoided those tough choices, both on transportation and on schools. In fact, the Senate’s budget proposal and several policy bills not only avoid those choices, they dig a deeper budget hole by creating more special-interest tax breaks and deferring more revenue.

The Senate-approved budget includes 18 new or extended tax breaks that cost $10.3 million in the current 2013-15 budget, but will cost nearly $120 million by the 2017-19 budget, according to estimates by the Washington State Budget and Policy Center. Similarly, Senate Republicans floated a transportation plan that exempts road projects from sales taxes, which essentially takes General Fund dollars away from schools and other state services to help fund transportation projects. That just digs a deeper education hole to toss some dirt in the transportation hole.

Another example is SB 6220. With a late lobbying push by restaurant and grocery lobbying groups, the Senate voted 26-23 last week to exempt supermarkets, big-box stores and other retailers from paying the 17 percent fee on liquor sales to restaurants, bars and other liquor resellers. Those fees were created as part of implementing Initiative 1183, the Costco-financed liquor privatization measure approved in 2011 that proponents promised would maintain — or increase — state revenue.

But since I-1183’s passage, Costco and other big retailers profiting on liquor sales have been pushing lawmakers to chip away at such fees, arguing that liquor taxes are too high. Last year, small privatized liquor stores were exempted from paying the 17 percent fee for sales to restaurants and bars. This year, the grocery and big-box stores want the same exemption so they can take more business from the smaller stores and the existing liquor distributors. SB 6220 would give them that.

The Teamsters, UFCW Local 21, and the Washington State Labor Council oppose SB 6220 because it would eliminate family-wage jobs at liquor distributors, which would still have to pay the 17 percent fee. But, in addition to killing those jobs, SB 6220 also digs a deeper budget hole. It would cost the state more than $1.2 million in the current budget and double that in the next biennium — plus future revenue projections are expected to show increased revenue losses to the state.

The McCleary decision suggests that $4.5 billion more per two-year budget cycle is needed for schools by 2018. The truth is, for a decade or more, both Democrats and Republicans have dug this budget hole by passing hundreds of large and “small” tax breaks like SB 6220. To the credit of House budget writers Reps. Reuven Carlyle (D-Seattle) and Ross Hunter (D-Medina), they are among the leaders who remember the first law of holes: when you’re in one, stop digging.

Pass bipartisan school construction plan

But if you insist on digging, make it a foundation for new and expanded public school buildings.

Among the clear goals set out in the McCleary decision was to reduce class sizes in Washington state, which are among the largest in the nation, and to provide full-day kindergarten. That’s not just a question of hiring more teachers. You need some place to put them. Last year, the Mukilteo school district turned down state funding to expand full-day kindergarten simply because they did not have the space. School districts from across the state have said that they don’t have the necessary classroom space to meet the goals outlined in McCleary.

Reps. Hans Dunshee (D-Snohomish) and Drew MacEwen (R-Union) introduced HB 2797 to sell $700 million in bonds backed by lottery revenue for grants dedicated to constructing classrooms for full-day kindergarten, as well as K-3 class-size reduction. It passed the House on a strong bipartisan 90-7 vote last week and was heard Monday in Senate Ways and Means.

Reps. Hans Dunshee (D-Snohomish) and Drew MacEwen (R-Union) introduced HB 2797 to sell $700 million in bonds backed by lottery revenue for grants dedicated to constructing classrooms for full-day kindergarten, as well as K-3 class-size reduction. It passed the House on a strong bipartisan 90-7 vote last week and was heard Monday in Senate Ways and Means.

State Treasurer Jim McIntire has reportedly raised some concerns that HB 2797 could negatively impact the state’s credit rating and make borrowing more expensive. But there are four other states that sell lottery-backed bonds and they continue to enjoy strong credit ratings.

“The most important factor impacting our state credit rating is creating strong economic growth which generates strong revenue streams,” said WSLC President Jeff Johnson, explaining why the council supports SB 2797.

“Reduced class sizes and all-day kindergarten play a critical role in a child’s success,” Dunshee said. “In order to accomplish these goals, new classrooms must be in place before teachers can show up for work. Across the state, east and west, schools struggle to find the space. This plan gives them the classrooms they need and creates 7,000 jobs at the same time.”

And we need those construction jobs.

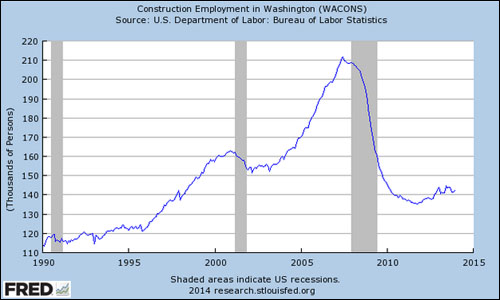

Last week, the Employment Security Department announced the state unemployment rate dropped to 6.4% in January and that, by some measures, the state has now recovered the jobs lost during the 2008-10 recession. But not in the construction industry. Check out this chart from the Federal Reserve Bank of St. Louis in its state-by-state assessment of the recession’s recovery.

Last week, the Employment Security Department announced the state unemployment rate dropped to 6.4% in January and that, by some measures, the state has now recovered the jobs lost during the 2008-10 recession. But not in the construction industry. Check out this chart from the Federal Reserve Bank of St. Louis in its state-by-state assessment of the recession’s recovery.

“As construction remains one of the relatively few blue-collar jobs that can’t be offshored, this graphic is one more piece of the problem of rising income inequality,” wrote Seattle Times business columnist Jon Talton.

Those 7,000 construction jobs created by HB 2797, which will be distributed throughout the state, are an important and timely bonus to meeting a clear goal of the McCleary decision.

The Washington State Labor Council, the State Building and Construction Trades Council, and the rest of organized labor strongly urge the Senate to pass HB 2797.

Up next: 2014 Report & Voting Record

As soon as the session ends this week, the Washington State Labor Council, AFL-CIO will begin compiling its 2014 Legislative Report and Voting Record. That publication, which summarizes the session and lists each legislators’ votes on important issues for working families, will be published in April.

Delegates representing the WSLC’s 600-plus affiliated unions will consider those voting records — along with candidate questionnaires and interviews—in deciding who to support in the 2014 elections this fall. They will look at which legislators were willing to support working families by voting for the shared prosperity agenda, job creation, and revenue growth to meet our state’s needs. Delegates will then gather on Saturday, May 10 at the Machinists District 751 Hall in Seattle for the WSLC Committee on Political Education (COPE) Convention to vote on election endorsements.

To learn how you can serve as a delegate, contact your local union. For more information about the COPE Convention, contact WSLC Political Director Karen Deal at 206-281-8901.