NATIONAL

Undocumented immigrants pay billions in taxes each year

The following if from the Institute on Taxation and Economic Policy:

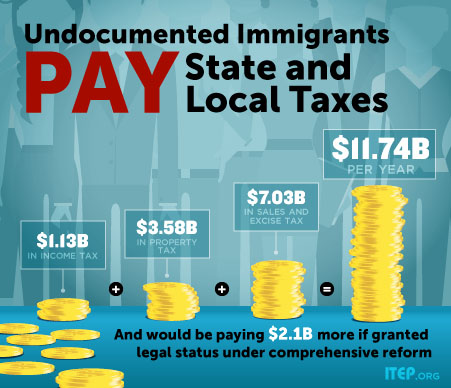

WASHINGTON, D.C. (March 6, 2017) — A newly updated report released last week provides data that helps dispute the erroneous idea espoused during President Trump’s address to Congress that undocumented immigrants are a drain to taxpayers. In fact, like all others living and working in the United States, undocumented immigrants are taxpayers too, and collectively contribute an estimated $11.74 billion to state and local coffers each year via a combination of sales and excise, personal income, and property taxes, according to Undocumented Immigrants’ State and Local Tax Contributions by the Institute on Taxation and Economic Policy.

In Washington state, undocumented immigrants pay more than $316 million in state and local taxes each year, according to the report. On average, the nation’s estimated 11 million undocumented immigrants pay 8 percent of their incomes in state and local taxes every year.

In Washington state, undocumented immigrants pay more than $316 million in state and local taxes each year, according to the report. On average, the nation’s estimated 11 million undocumented immigrants pay 8 percent of their incomes in state and local taxes every year.

While it is unlikely to happen in the current political environment, undocumented immigrants’ state and local tax contributions could increase by up to $2.1 billion under comprehensive immigration reform, boosting their effective tax rate to 8.6 percent.

“Good policy is informed policy,” said Meg Wiehe, ITEP director of programs. “Just as the horrendous impact of breaking up families under a mass deportation policy should not be ignored, nor should policymakers overlook the significant contributions undocumented immigrants make to our state and local revenues and the economy.”

“Keep in mind most state and local taxes are collected from people regardless of citizenship status,” Wiehe added. “Undocumented immigrants, like everyone else, pay sales and excise taxes when they purchase goods and services. They pay property taxes directly on their homes or indirectly as renters. And, many undocumented immigrants also pay state income taxes.”

The report provides critical context at a time when the president is pushing immigration policies that partly rely on the flawed assumption that immigrants are a drain on the nation’s economy. It includes state-by-state and national estimates on undocumented immigrants’ current state and local tax contributions.

Key findings:

► Undocumented immigrants contribute significantly to state and local governments, collectively paying an estimated $11.74 billion in state and local taxes. Contributions range from just over $550,000 in Montana, with an estimated undocumented population of 1,000, to more than $3.1 billion in California, home to more than 3 million undocumented immigrants.

► Undocumented immigrants’ nationwide average effective state and local tax rate (the share of income they pay in state and local taxes) is an estimated 8 percent. For comparison, the top 1 percent of taxpayers pay an average effective tax rate of just 5.4 percent, and the average effective rate for the middle quintile is 8.7 percent. So, undocumented immigrants are paying an average effective state and local tax rate that is on par with middle-income taxpayers.

► Granting legal status to all 11 million undocumented immigrants as part of a comprehensive immigration reform and allowing them to work in the United States legally would increase their state and local tax contributions by an estimated $2.1 billion a year. Their effective tax rate would increase from 8 to 8.6 percent.

► There is no doubt a mass deportation policy would have an impact on businesses and the economy. There would also be an immediate impact on many state and local coffers without the tax contributions of undocumented immigrants.

This report focuses on state and local taxes, but its findings mirror those at the federal level. Many undocumented immigrants pay federal payroll and income taxes as well as excise taxes on items such as fuel. Full immigration reform at the federal level would decrease the deficit and generate more than $450 billion in additional federal revenue over the next decade, according to a 2010 report from the non-partisan Congressional Budget Office.

Click here to view the full ITEP report and find more state-specific data.